Revisiting The Enablers: The Firms Behind Fossil Fuel Falsehoods

Guests

Michael Forsythe

Ben Franta

Jamie Henn

Christine Arena

Summary

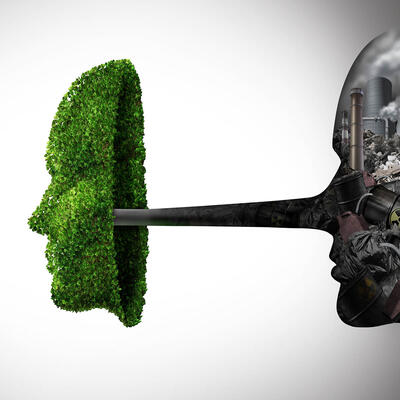

For years, fossil fuel companies have claimed to support climate science and policy. Many have recently pledged to hit net zero emissions by midcentury. Yet behind the scenes, they fight those very same policies through industry associations, shadow groups, and lobbying – all while spending vast sums on advertising and PR campaigns touting their climate commitments. And they don’t do it alone. They’re aided and abetted by PR firms, ad agencies and business consultancies like McKinsey & Company.

Michael Forsythe, New York Times investigative reporter and co-author of the book “When McKinsey Comes to Town: The Hidden Influence of the World's Most Powerful Consulting Firm” says this one global consultancy wields far greater influence than more public-facing corporate giants like Amazon and Google. “McKinsey works with almost all the companies in the world and has influence on almost all the major companies in the world and many of the governments.”

Fossil fuel companies are McKinsey’s bread and butter. When pressed by a group of young employees to take real action on climate and push their clients to do the same, senior executives said they couldn't stop working with their fossil fuel clients and remain relevant.

“No one is saying that McKinsey shouldn't work with these companies,” says Forsythe. “What we’re saying is and what the McKinsey employees were saying is that McKinsey should work to reduce the carbon emissions from these companies.”

PR firms and global ad agencies like Edelman also work to protect the fossil fuel industry and slow down the clean energy transition. Despite fossil fuel advertising that touts their clean energy endeavors, that’s not where the money is really going.

For example, a House Oversight Committee reports that from 2010 to 2018, BP spent about 2% of its capital expenditures on low carbon investments. Exxon spent less than a quarter of 1% on cleaner energy. Jamie Henn, founder and director of Clean Creatives, says these numbers tella story that big oil’s supposed commitment to climate action is little more than greenwashing.

“ExxonMobil just made record profits because of high gas prices,” says Henn. “And what are they doing with it? They are telling their shareholders that they are going to increase oil and gas production, and they're doing a $10 billion stock buyback to reward their shareholders. In comparison ExxonMobil spent maybe upwards of about $300 million on algae research, which over the last 10 years, so that's about 30 million a year maybe. Yet that's the focus of all their advertising.”

Despite how much money these companies have to spend, they are still losing the battle of public perception. 60% of Americans say that fossil fuel companies are to blame for the climate crisis and about 50% of them want them to pay damages.

Christina Arena, former VP at the global PR firm Edelman, argues that proponents of clean energy can use this reality to help deal with the climate crisis: “I think that opens the door for clean tech marketers and clean energy marketers to come in with a more compelling narrative. Tell your story better be more creative. Capture America's hearts and minds.”

Resources From This Episode (2)

Full Transcript

Note: Transcripts are generated using a combination of automated software and human transcribers, and may contain errors. Please check the actual audio before quoting it.

Greg Dalton: This is Climate One. I’m Greg Dalton. For years, fossil fuel companies have claimed to support climate science and public policy advancing decarbonization. Many have recently pledged to hit net zero emissions by midcentury. Yet behind the scenes they fight those very same policies, through industry associations, shadow groups, and lobbying. All while spending vast sums on advertising and PR campaigns touting their climate commitments.

This week we’re looking at some of the entities that help these companies slow the transition away from fossil fuels, starting with consultants and public relations firms. Many of these groups are now facing their own pressure to drop their fossil fuel clients.

A new book profiling the power and influence of consulting firm McKinsey and Company has drawn attention to their work helping maximize “efficiency” and profits for fossil fuel companies and other large emitters.

New York Times investigative reporter Michael Forsythe, co-author of the book When McKinsey Comes to Town, spoke with Climate One’s Ariana Brocious.

Ariana Brocious: Let's start by talking about the power of this consultancy firm, it’s mostly hidden and yet incredibly pervasive. You write the firm has advised virtually every pharmaceutical company and their government regulators, along with health insurers, airlines, universities, museums, weapon makers, private equity firms and so on. It operates in more than 65 countries. As you are reporting this what surprised you about the extent of McKinsey’s influence?

Michael Forsythe: I think that the thing that surprised me the most was the pervasiveness of it. There's plenty of powerful companies in the world, you know, Exxon Mobil, for example, Amazon, Google. These are all huge companies that affect the lives of almost everybody, especially in the United States but around the world. But McKinsey works with almost all the companies in the world and has influence on almost all the major companies in the world and many of the governments. And you know we wouldn't have written the book unless we thought that the advice that McKinsey gave actually made a difference.

Ariana Brocious: Right. And maybe that the public needs to be more aware of their influence.

Michael Forsythe: Absolutely.

Ariana Brocious: So, unlike some other companies McKinsey often advises companies that are actively in opposition or regulators and those they regulate simultaneously. They say internal firewalls protect each client's interest. How real or effective do you think those firewalls really are?

Michael Forsythe: So yes, that is the mantra that you know McKinsey has long worked for many companies in the same industry field. Like, you know, for example working for Allstate or State Farm at the same time. They say they have firewalls; certain consultants can’t work for two different companies in the same field. But we've seen especially recently, some documents coming out especially in the pharmaceutical area where there was one senior consultant who was working for two opioid makers at the same time. And we also found that some of the consultants working for these opioid makers like Purdue Pharma were also working on projects for the FDA, the regulator of these drug makers.

Ariana Brocious: That’s pretty staggering. I don't know, it seems like that should be disclosed, right?

Michael Forsythe: It’s something that Congress is certainly taking a look at. I think a lot of people in Congress and there were hearings on this in April actually are also very concerned that McKinsey is advising companies that are regulated and the regulator as well.

Ariana Brocious: So, McKinsey markets itself to young Ivy League grads as a values driven place to work, where they can play a role in changing the world for good. Yet many of those that you spoke to for this book had a different experience actually working there. And I was hoping you could tell us about the story of Erik Edstrom.

Michael Forsythe: Sure. So, Erik Edstrom is actually not an Ivy League graduate, he's a West Point graduate and then he went to Oxford, you know. I guess the British Ivy League equivalent, to get a masters. And he focused in the environment and climate, you know, while getting his masters at Oxford. And, you know, he is one of the many highly idealistic people that McKinsey has recruited. And McKinsey is very successful in recruiting some of these people because they really do appeal to their idealism. Don't go work for Goldman Sachs or some other bank, you know. At McKinsey you can make a difference, you can make an impact on the world and often in that recruiting process they focus on some of the things like climate change like you know spreading vaccines against polio in Africa. These really good projects that really do make a difference in the world. The thing is when they start working at McKinsey some of those people are quickly disabused of that because they're working not for those companies.

Ariana Brocious: You write about how there's sort of a culture internally of needing to be active in kind of in the game, right. And so, a new hire decides they don't want to work on something because of values driven judgment, then they're kind of benched and they might miss the opportunity to actually prove themselves and then have a position, right?

Michael Forsythe: That’s right. So, McKinsey does have this policy and they do honor it of allowing people to opt out of certain types of work. Like working for a coal mining company or a tobacco maker or an opioid maker for example. The problem we found with that is that puts the ethical dilemma and the ethical choice on very young consultants, you know, these 25, 26-year-old people. And so, they're the ones that have to make the ethical choice, not the company itself. And so, we found that McKinsey only stopped advising tobacco makers last year in 2021, which is I think that's absolutely nuts. That’s 57 years after the Surgeon General said that smoking causes cancer, 57 years, you know, And for Erik, you know, he's in Australia – that's where he was hired by McKinsey. He was working in the Melbourne office. That is the city in Australia that is also the headquarters for some of the big resources companies like Rio Tinto. I think BHP is also there. Coal mining is a big industry and that's something he opted out of, and, you know, some other people. And that does deny them a chance to work with certain partners, you know, that may advance their careers. And when they don't have an assignment to work on it’s called being put on the beach. That's what’s it’s called in the internal McKinsey parlance, you know. You don't have an assignment and if you opt yourself out of those some of these assignments, and especially there are so much of that work in Australia it could really crimp and hurt your McKinsey career.

Ariana Brocious: So, McKinsey publicly advocates for climate action and they publish clear eyed analyses on the risks faced by the climate crisis. The McKinsey cost curves are a seminal piece of work in decarbonizing the global economy. But you report that today the firm's recommendations tend toward feel-good market actions rather than government policy. Why is that?

Michael Forsythe: Yeah, so, I think McKinsey has done a lot of good work in the climate field. And you mentioned the climate cost curves. I think they came out in 2007. That was new and used by many people. And also, McKinsey you know does play to its strengths for some of its best climate work which is the ability to synthesize, you know data and present it in a way that is understandable. And they've done that they're very clear. A certain part of McKinsey is very clear eyed about the dangers and the problems and the crisis, you know, that's caused by you know, increasing carbon emissions. That's one part of McKinsey. The other part, the part that really makes the money is its extensive work with the biggest carbon emitters of the world. And if they were working with those companies to reduce their carbon footprints, well then, all the power to McKinsey. But we discovered that a lot of the work that McKinsey does with these companies has nothing to do with making them greener.

Ariana Brocious: Right. They work to make coal companies more profitable and actually extend the life of fossil fuels or our continued dependence on them.

Michael Forsythe: That's right. And that's something that really upset Erik Edstrom. Again, you know, Eric he's an American West Point graduate, he fought in Afghanistan as a platoon leader as a young junior officer. He's a man of strong ideals. And he just saw in Australia that McKinsey was promoting this success story, you know, turning a coal mine into a diamond where a McKinsey team went in and increased production at a coal mining company by 26%. And this was viewed as a good thing; it's akin to you know, we went into Phillip Morris and we found a way for them to increase tobacco consumption by 26%. We got more people smoking, bravo us. You know it's the same thing. And the idea that the company thought that this was something laudatory that they passed around as an attaboy really incensed Erik. And he wrote the mother of all farewell letters when he did leave the company in July of 2019 where he mentioned this particular note about this coal mine increase.

Ariana Brocious: Well, and that conflict of know, on the one hand, producing really useful data and analyses about the climate crisis and the risks faced by organizations. And on the other hand, actually helping these big fossil fuel companies continue to grow or develop. You mentioned that there's, you know, a real profit incentive here and that some of these companies are the most profitable. So, what's the business case for hiring a firm to cut emissions and is there any of that activity happening?

Michael Forsythe: There certainly is, you know, and McKinsey pointed out in their responses to us that they have worked with fossil fuel companies to help reduce their emissions. They said in one case they helped an energy company cut their emissions by 82% which is pretty darn good. But the big clients, the really big clients, the ones with the deep pockets. The Chevrons, Exxonmobils of the world. They may not necessarily be interested in that kind of work. And certainly, we had to look at a way to just an amazing leak I guess you would call it where we got a chance to look at McKinsey's biggest clients, Chevron's among them and also the kind of work McKinsey was doing for them. And it's certainly nothing on the Chevron list gave any indication it was a carbon work reduction. It was all about increasing efficiency, you know, analyzing upstream oil production, digitizing things that kind of work. And, you know, so the work done with some of these big companies really in many cases has everything to do with them being able to be more efficient. And when I say efficient, I mean, cost-efficient producers of carbon. Whether it’s oil, natural gas or coal.

Ariana Brocious: So, when pressed by a group of young McKinsey employees to take real action on climate and push their clients to do the same, senior executives said they couldn't stop working with their fossil fuel clients and remain relevant, citing the need to stay in relationship with clients in order to influence them. And this echoes the defense given by the head of PR firm Edelman in response to similar pressure from their employees. So, based on what you were able to find, does this kind of constructive engagement with clients work that McKinsey is arguing for?

Michael Forsythe: Yeah. So, in many instances with McKinsey the pressure from within from consultants does seem to have some sort of effect. This was certainly the case, you know, when a lot of junior consultants, especially were upset about its work with ICE the Immigration Customs Enforcement Agency. With climate it's kind of like Pharaoh's heart has hardened. So, just to give you an idea of the extent of McKinsey's work. So, in the past few years McKinsey's worked with 43 of the top 100 carbon emitters in the world. And those companies, those 43 companies in 2018, were responsible for 36% of the planet’s carbon output. So, McKinsey works with the big boys. And this is a lot of revenue for McKinsey. So, the argument that McKinsey had is and I just want to read it to you because I find it extraordinary. I'm just gonna read the chapter here because, so this, these are words actually from the current managing partner of McKinsey, a guy named Bob Sternfels. He lives in San Francisco in the Bay Area. Went to Stanford and was a Rhodes scholar. so, Bob Sternfels kind of gave a prebuttal to an article we wrote, in October 2021 for the New York Times. They knew the article was coming so he decided, I mean McKinsey decided to do a prebuttal in the Wall Street Journal on their editorial page. And he said, “companies can't go from brown to green without getting a little dirty. And if that means some mud gets thrown at McKinsey, so be it.” Coming from a Rhodes scholar, I have to say that was a kind of unusual argument. No one is saying that McKinsey shouldn't work with these companies. What we’re saying is and what the McKinsey employees were saying is that McKinsey should work to reduce the carbon emissions from these companies. In this instance, even though 1100 McKinsey consultants, you know, McKinsey employees sign this petition to get McKinsey to focus more on reducing carbon emissions from its big clients and actually publicizing the emissions of its clients and letting people know. Certainly, the pushback was strong.

Ariana Brocious: And you sort of touched on this, but if they took a stance of wanting to prioritize carbon reductions with those relationships with these long-term clients, these big oil majors. What kind of positive influence could they have?

Michael Forsythe: So, one of the strengths of McKinsey is that it communicates best practices, industry best practices. And so, you know, one of the advantages of McKinsey working with competitors in the same industry is that they learn a lot. The company is a knowledge company in a lot of ways. And so, you know, while it can't take the you know, trade secrets of Total and BP and give them to Chevron it certainly can anonymize some of the lessons that it’s learned and pass them on to Chevron or Exxon Mobil. The big problem here though is that McKinsey is hired by these companies. McKinsey works for them. Does what the client wants them to do. And if these clients aren’t asking them to help them reduce their carbon footprint then McKinsey's not going to be doing that kind of work with them. And, you know, I mean you see a lot of ads on TV about like algae, you know that Chevron is growing. I've seen them for years and years. I think they’ve gotten more mileage out of their algae ads than the money they’ve actually put into algae research. But, you know, it doesn’t strike me that Chevron and ExxonMobil and some of the big US oil majors are that committed. You have companies in Europe, oil companies in Europe that are actually cutting their dividend payments in order to transition more quickly to a carbon free future.

Ariana Brocious: Yeah, those algae ads are classic case of greenwashing. The amount of money being invested in that versus their overall operations is insignificant to say the least.

Michael Forsythe: Right. Right. And ExxonMobil same thing with their carbon capture and storage that they’ve been talking about for over a decade now. They keep talking about it and talking and talking and talking.

Ariana Brocious: So, how has senior leadership responded to these apparent contradictions between their values and their actions that you cover in the book and particularly these climate aspects?

Michael Forsythe: Yeah. So, as I said, you know, with climate I think they’ve pushed back quite strongly. Because of the revenue I would surmise it's because of the importance of these energy companies. With the other issue so you know over the last few years that you know my colleague Walt Bogdanich and I have been writing about McKinsey. They have changed a little bit the way they select clients a little bit more careful. I think new systems and process is in place to make sure that they don't work with authoritarian countries, or at least with you know the police or defense ministries or justice ministries and authoritarian countries. So, they have made some kind of changes. And they have for climate they have launched some new initiatives to focus on this area. But as far as we know the most important thing which is to be working on carbon reductions for its big carbon emitter clients. And that really hasn’t changed and they're still doing the work for Aramco and Chevron and Exxon that Aramco, Chevron and Exxon want them to work on.

Ariana Brocious: How did your thoughts about capitalism evolve over the course of writing this book?

Michael Forsythe: Yeah, so, I'm a big believer in free markets and the power of free markets to present innovation. but I do think that with capitalism must come some responsibility. And it's the responsibility over free press and also the government to keep capitalism in check. And that's the thing about McKinsey. So many McKinsey consultants, especially former consultants have said that McKinsey's work is often an accelerant. You know, it adds fuel to the fire. Whether it's turbocharging opioid sales, you know, it’s focused on shareholder value. It's focused on whatever the client wants and whatever the client wants is usually to increase their profits. This has been McKinsey's work. They really have profited off the rise of shareholder capitalism.

Ariana Brocious: Mike Forsythe is a reporter on the investigations team at the New York Times and co-author of the book When McKinsey Comes to Town. Mike, thanks so much for joining us on Climate One.

Michael Forsythe: My pleasure.

Greg Dalton: This is Climate One. I’m Greg Dalton. Let's get some historical perspective on what fossil fuel companies knew about their effect on the climate. Dr. Benjamin Franta is Head of the Climate Litigation Lab at the Oxford Sustainable Law Programme. Climate One’s Ariana Brocious takes it from here.

Ariana Brocious: Through years of research, Dr. Benjamin Franta and others have uncovered just how long fossil companies have known their products could hurt the climate–and how long they avoided telling anyone about it. Franta found one key example of this from more than 60 years ago in a Delaware archive.

Ben Franta: It was a speech given by Edward Teller, the famous physicist who worked on the hydrogen bomb, and he was giving a speech to an industry audience. It was a special conference put on by the American Petroleum Institute in 1959. And he warned them about the eventuality of global warming from fossil fuels and that that energy supply, that fossil fuels would have to be replaced.

Ariana Brocious: Franta says in the subsequent decades, the industry’s understanding of the climate impacts of fossil fuels only continued to grow.

Ben Franta: And by the early 1980s, the industry had a very sophisticated understanding of the issue. We now have internal reports from companies like Exxon from that time that predict very accurately how global warming would develop, many of the impacts and also had a clear understanding that the central problem causing it was fossil fuels and that fossil fuels would need to be replaced to stop the problem from developing. Around that time, I'm talking about the early 1980s even the late 1970s, scientists studying this problem and companies like Exxon were aware of the fact that if climate change was going to be avoided it was time to act then.

Ariana Brocious: This understanding wasn’t limited to U.S. companies, though some of them were leaders in hiding the facts. Instead of taking action on climate, companies did the opposite.

Ben Franta: In the mid-1980s Exxon informed many of the other oil companies about this issue, and essentially raised a red flag for them and said we’re going to be regulated as an industry because of this climate problem. And we as an industry need to be prepared and have a counter response ready to deal with climate legislation and climate treaties.

Ariana Brocious: Franta says throughout the 1980s, French company Total and others followed the strategies developed by Exxon to dispute and counter climate science.

Ben Franta: These included things like emphasizing the cost of climate action and deemphasizing the benefits of climate action and even distraction techniques which might surprise you things like emphasizing the need for reforestation or efficiency like these are things that alone would be good but they were deployed by the industry in order to distract attention away from fossil fuels. And they’ve been doing it ever since.

Ariana Brocious: In the late 90s and early 2000s, the industry started to reposition itself as integral to solving climate change.

Ben Franta: That's when the industry really began promoting things like carbon capture, things like hydrogen and almost all hydrogen is made from natural gas is made from fossil fuel currently, at least. But basically, promoting industry friendly solutions to climate change that really you know have at least so far have not really been solutions but have continued to perpetuate the fossil fuel regime.

Ariana Brocious: Those tactics included shifting the blame to the public by popularizing the idea of an individual carbon footprint and personal sustainability.

Ben Franta: There are ad campaigns from the early 2000s that portray climate change as the fault of individual consumers and encourages them to do things like carpool more or change their light bulbs and portrays the fossil fuel companies as the leaders. And it was even worse because in reality those fossil fuel companies were not in fact taking the lead to address climate change. They weren't investing substantially in renewables, for example.

Ariana Brocious: Another frequent tactic of fossil fuel companies has been the use of so-called “advertorials” in major newspapers like the New York Times – often a full page ad written in the form of an op-ed.

Ben Franta: So, it’s made to look authoritative and neutral or objective but in reality, it's paid for by in this case a company like Exxon. And Exxon took these out you know for many, many years in the New York Times and used them to cast doubt on climate science but also to convince the public that climate action would be too expensive to undertake, that it would hurt the economy. And in fact, sometimes Exxon would cite studies by economists that said this, but those economists had actually been paid to do those studies by the oil industry. So, there's a lot of trickery involved and you know these were messages seen by huge numbers of people because they're in these, you know, very mainstream incredible authoritative newspapers like the New York Times.

The New York Times still runs these sorts of ads for fossil fuel companies, and many of those ads still contain false and misleading statements like calling natural gas clean or exaggerating the amount of investment in renewables that the oil companies are making. And that of course skews all of our perceptions of what these companies are doing and, in a way, that New York Times stamp of approval on that ad it’s a form of the third-party technique. It's people who might not necessarily trust Exxon, but they might trust the New York Times and so they see it in the New York Times and they believe that message.

Ariana Brocious: These tactics – especially the economic arguments–have also been targeted at politicians, policy makers and business leaders.

Ben Franta: I saw then-President Trump give his announcement to pull the US out of the Paris Agreement. And to justify that he cited an economic study paid for by the industry and written by some of the very same economists who have been doing this for the industry since the 90s. And so, this strategy is still going on. It's still affecting public policy at the highest levels. And, you know, we need more oversight of that. We need to understand that whole phenomenon better, you know, because the future is at stake.

Ariana Brocious: In recent years, Franta says the fossil fuel industry has shifted to more greenwashing or climate washing techniques, often via social media.

Ben Franta: We see this all the time now with major oil companies. Exxon Mobil might be bragging about how much carbon capture it's doing, but if you actually run the numbers it's minuscule. So, they sort of specialize in giving a narrowly true fact that is presented in an overall misleading way. So, it's sort of a sin of omission or a sin of presentation.

Ariana Brocious: But there’s growing public awareness of this greenwashing, which Franta says is the first step in combating it.

Ben Franta: Because if the public is aware of the trickery, then the trickery doesn't work as well. But also, this is unlawful, often, to deceive the public in this way about your company or about your products. And so, different parties can bring climate lawsuits that focus on greenwashing and try to put an end to it. And, you know, we’ve seen some suits like this in the United States and we’ve seen suits like this in other countries in Europe for example. And I think we’re gonna see a lot of these kinds of lawsuits as companies make climate pledges, as they try to green their images, as they make net zero commitments that might not actually have anything behind them. That's gonna be an important accountability mechanism to ensure that what these companies say they're doing or portraying themselves as doing, that they're actually doing that and not just not as trying to look good. So, it's a very, very important legal campaign, global in scope and the stakes are very high of course, because it’s going to affect the long, long-term future of the planet.

Greg Dalton: Dr. Benjamin Franta is Head of the Climate Litigation Lab with the Sustainable Law Programme at Oxford University.

We’re talking about the firms that enable fossil fuel companies to maintain their social license to operate. I’ve invited a couple guests to weigh in: Christine Arena is a former Executive Vice President at Edelman and founder of the production company Generous Films, and Jamie Henn is founder and director of Clean Creatives, a project for PR and ad professionals who want a safe climate future.

Companies spend a lot of money on advertising and messaging in order to appear more climate conscious. ExxonMobil is one big oil company to announce that it aims to achieve net zero greenhouse gas emissions by 2050. But Exxon's plans only cover Scope 1 and Scope 2 emissions, meaning it won't cover its biggest carbon impact: consumers burning the fossil fuel that it generates. Those are called Scope 3 emissions. I asked Christine Arena what she thinks about net zero pledges from fossil fuel producers.

Christine Arena: Practically none of them to your point include Scope 3 emissions; they don't factor in the actual emissions generated when people use their products is a little bit deceptive. I think that at the very least, these marketers need to include the fine print so that people understand that Scope 1 and 2 emissions basically mean bringing fossil fuels to market more efficiently, not decarbonizing our economy not scaling back on the emissions that scientists say we need to focus on

Greg Dalton: Many large oil and gas companies say they support a price on carbon pollution. Yet the House oversight committee reports that less than half of 1% of their lobbying effort over the past decade focused on carbon pricing. The committee also reports that from 2010 to 2018, BP spent about 2% of its capital expenditures or CapEx on low carbon investments. Exxon spent less than a quarter of 1% on cleaner energy. Large oil companies are spending pennies on carbon pricing policies and low carbon energy. I’ve asked executives in the past to specify their CapEx on renewables and they dance around the actual number. Jaime, what story do those numbers tell about capital expenditures and lobbying?

Jaime Henn: Well, I think it tells a story that big oil's supposed commitment to climate action is little more than greenwashing. ExxonMobil just made record profits because of high gas prices. And what are they doing with it? They are telling their shareholders that they are going to increase oil and gas production, and they're doing a $10 billion stock buyback to reward their shareholders. In comparison, ExxonMobil spent maybe upwards of about $300 million on algae research, which over the last 10 years, so that's about 30 million a year maybe. Yet that's the focus of all their advertising; it’s all about how they’re making fuel out of algae and things like that. So, again when you actually peel back the glossy advertisements and messaging from the industry the real numbers show that practically they're spending more on burnishing their image than they actually are changing their business plans.

Greg Dalton: Christine, there's a line from a Guardian article about this that stands out. It says, “Oil companies almost never advertise their products, opting instead to advertise ideas, particularly the idea that they're working hard to address the climate crisis." Give us a sense of how PR firms work with fossil fuel clients on messaging and the relationship of their product versus making people feel they’re on the same side.

Christine Arena: Fossil fuel marketers are basically bombarding us with their messages, doing very aggressive media buys across channels, right? So, if you have logged into Twitter, Facebook, the New York Times, Politico, or listened to a podcast recently, chances are you've probably heard a fossil fuel ad, and really, if you look at the nature of those very, very pervasive ad messages you're right, they're not really selling us products. They are advertising ideas. They are advertising ideas that they're far more socially and environmentally responsible than they are in reality. Ideas that we can't live without them that it's dangerous to imagine a future free from fossil fuels and ideas that just generally confuse people about climate change and what the real solutions are. So, I think this is a very dangerous mix. This mix of misleading messages from fossil fuel marketers amplified so aggressively across media channels. This is a systemic issue, and it's an issue that is a serious problem because fossil fuel marketers aren’t restricted the same way tobacco or opioid marketers are. And they’re spending vast resources so their agency partners are turning around and creating these messages and programs and social and ad platforms are themselves not incentivized to police misinformation or police the problem. So, this is a systemic issue and to your question, you know, what is that role that PR partners play well, you know, they basically take the client’s money and execute messaging that fits the objective of that client. The objective of most fossil fuel ads is you know to do one of two things. Either you know it's not to transition us away from clean energy anytime soon. The agenda and the messaging are designed to keep the demands for fossil fuel products up and to avoid regulatory intervention and that's why they're trying so hard to influence public opinion and reaching out so aggressively.

Greg Dalton: And so, what is the possible avenue for regulatory intervention? Obviously, we have, you know, First Amendment, etc. regulating free speech very contentious. Is there a path for oversight by a government entity?

Christine Arena: There is, and if you look at opioids or tobacco, they provide models. Fossil fuel products kill 8.7 million people a year through pollution. If you compare those numbers to fatalities in tobacco, you know, tobacco products kill about 480,000 people year opioids, I think deaths from opioids are at about 70,000 a year. So, why aren't fossil fuel marketers restricted in the same way that tobacco marketers are? There are clearly mechanisms for this level of intervention it just hasn't happened yet and that is partly thanks to the power of the fossil fuel lobby.

Greg Dalton: Jamie, you lead Clean Creatives that campaign pressuring public relations and advertising agencies to quit working with fossil fuel companies to spread climate disinformation. In January, your group joined with more than 450 scientists who signed a letter calling on advertising at PR agencies to drop their fossil fuel clients. What was the impact of what you’re trying to achieve?

Jaime Henn: Well, I think the impact of that letter really showed that this is a topic that PR and advertising agencies can no longer avoid. I think the role of PR in advertising in blocking climate action has been hiding in plain sight for years because it's the water we swim in every day. It's the messages, the advertisements that create the reality in the very language that we used to talk about the climate crisis. And as we've seen over the last few decades. These industries have played a huge role in blocking the type of conversation that we need to have about climate change and then the type of political action that could result from that. So, about a year ago my colleague and friend Duncan Meisel and I were looking out there and actually seeing all of this advertising out there that was flowing during the 2020 election and feeling like there had to be a way that we could begin to try and dismantle or at the very least throw a wrench into the gears of this propaganda machine. And so, we launched Clean Creatives as an effort to really go after the PR and ad agencies that work most closely with the fossil fuel industry. The idea being that ExxonMobil, you know, their business plan really depends on selling oil but a firm like Edelman or WPP they can make money doing all sorts of things. They could work with sustainability-oriented clients. They can work with really big companies like GM which you know doesn't have a perfect track record, but is making the transition to electric vehicles and trying to move into this clean energy economy. So, the idea was that these were really essential agencies that were a part of the way the fossil fuel industry blocked progress but they were also movable targets who we could really bring onto the right side of this issue and tap into the incredible talent that exists in the creative sector. And instead of using that to destroy creation try and get those creatives to actually help address the climate crisis

Greg Dalton: In late 2022, PR firm Edelman released a global survey finding that business has a trust problem on sustainability. The survey of 14,000 people found that national governments have a stunning 22-point advantage over business when it comes to which institutions people think should lead on climate change. That report was issued after we recorded our conversation with Jaime Henn, Founder of the Clean Creatives campaign and Christine Arena, former Executive Vice President at Edelman. We spoke shortly after reporting from The New York Times revealed that Edelman’s CEO told staff the company would not walk away from fossil fuel clients who need its services as they transition to clean energy. I asked Christine how much this kind of outside pressure has shifted Edelman’s business model.

Christine Arena: Well, I didn't expect Edelman to walk away from very lucrative client contracts. I mean we know that between 2008 and 2018 Edelman did about half a billion dollars worth of work for that’s just trade associations fossil fuel trade associations, including the American Petroleum Institute, the American Fuel and Petrochemical Manufacturers, National Mining Association and others. So, Edelman has different practices and the energy practice is extremely lucrative. So, I don't expect them to divest. But what I do expect is for them to continue to be a primary target for lawmakers and that's not just because of activist campaigns are my personal experience, but it's because there is real evidence showing how PR firms have played that central role in promoting misinformation on behalf of fossil fuel clients. I do suspect that that the focus and scrutiny on this industry will increase, not decrease. I am concerned that the industry is just really unwilling to acknowledge the core problem of misleading communications. PR firms just haven't wanted to talk about this despite the fact that there is an ongoing congressional investigation into climate disinformation. There are 13 active state AG lawsuits that center on that basis of misleading communications in advertising. I just think that PR and ad firms are in a position where they're not only having to fight off activists but they're under some real scrutiny. So, I just think this is a conversation the industry needs to have much more openly and it needs to take actions to stop damaging potentially communities through misleading marketing communications.

Greg Dalton: We invited Edelman to join this discussion and they declined. Our invitation is still open and hope they’ll come on another time. Jaime, Chevron is hiring journalists who work in an internal “newsroom” to cover stories it doesn’t think mainstream outlets will write about. Isn't it possible that oil companies can just bring these functions in house and they may not need ad agencies or PR shops?

Jaime Henn: Well, I think you are seeing that from a variety of different fossil fuel companies and it's a real concern. Chevron's been engaged in a fight for years over in Richmond, California, which is the largest point source, their refinery there is the largest point source of pollution in the entire state of California and had a devastating impact on the local community with their air pollution. And, yeah, Chevron started not only hired its own journalist, they started their entire own newspaper to try and put out their own spin on the news about local issues in Richmond. And of course, accompanied that with the major political campaign to try and take over the Richmond City Council. I think thanks to the work of grassroots communities there, activists and community members were really able to push back on that. And that is where the hope lies. I think that the fossil fuel industry when it tries to be so egregious to go so far to create their own newspaper or create their own content, they do tend to get called out on that. And I think people are a little bit sharper consumers these days and when they see stuff that looks so clearly like propaganda, they’re able to push back on that. And I think so examples like that are places where I think we’re able to try and make progress. I think the bigger risk is when actually a fossil fuel company isn't putting forward outright climate denial, but they're actually talking about solutions when they pretend to be our friend. That’s the harder stuff to really cut through. But ultimately, it's just as damaging because the goal of that content is to delay the type of public outrage and ultimately political pressure that could cause these companies to really change. And so, in some ways I'm less worried about Chevron coming out there and really pushing back on regulations. I'm more worried about them pretending that they are big fans of climate action when in fact they’re lobbying behind the scenes to block regulations everywhere from the local level all the way up to the international.

Greg Dalton: Yeah, these days everyone agrees on decarbonization and net zero; the debate is really about how fast. Whether it takes decades or centuries, or happen on the timeline that science wants.

Jaime Henn: I think that’s really critical because we've had the conversation with a lot of advertisers who we've talked to about signing our pledge and they say hold on a second, we’re working with BP or Shell all about their climate solutions and how much they care about the issue. So, we’re helping the transition happen by putting out advertising from BP about how committed they are to climate action. And I think the thing to understand is that that is exactly the tactics that an industry under pressure would do, right. They want to act as if they’re solving the problem; they want to pretend as if they're making progress so that they won't face the type of pressure and regulations that would cause them to really change. And so, that advertising that “helping” is actually even more damaging. And I think that that's hard for people to hear because it is a beautiful ad about how committed BP is to climate action. But when only a few percentage points of their capital expenditures are going to clean energy and the rest is being poured into fossil fuels, that ultimately is false advertising and it should be called out as such, and ultimately regulated as such.

Greg Dalton: Let’s look to the other side. Christine, the clean energy sector is growing quickly, but it's a small amount and it’s fragmented compared to fossil fuels. They don't spend as much on advertising. They don't have the mega national consumer brands that happen that we know from the oil companies. Although car companies are starting to advertise EVs more, you know. Look at that side of it where is the power and the brand power and spending power on the clean side. Because ultimately these firms will move when there’s money to be made by these other clients.

Christine Arena: Well, yes, I mean, look, the fossil fuel industry is unique in that they have an exorbitant amount of money to spend. it's just a huge industry and clean tech marketers can't match that scale at this level. But what they can do is command the narrative. Fossil fuel marketers even though their messages are so pervasive even though they're so aggressive about telling their story and trying to position themselves as part of the solution, people are losing faith in fossil fuel companies. We have about 60% of Americans right now saying that fossil fuel believing that fossil fuel companies are to blame for the climate crisis and about 50% of them want them to pay damages. And that's now I think that's only gonna increase. So, this industry is kind of losing control of the narrative, even though it is trying so hard to direct it. And so, I think that opens the door for clean tech marketers and clean energy marketers to come in with a more compelling narrative. Tell your story better; be more creative. Capture America's hearts and minds.

Greg Dalton: Jaime, how do you see the power dynamics there of this sort of less mature, more fragmented, less wealthy clean energy sector, compared to these fossil giants who have been around and had 100 years to accumulate power and brand?

Jaime Henn: Well, I think Christine put it exactly right. I mean there’s no doubt that right now the oil and gas sector is dramatically outspending clean energy when it comes to PR and advertising. We did a report to launch the Clean Creatives campaign that looked at some data that we had available and this was between 2014 and 2018, which there’s a lag time because it's hard to get this information from advertisers at certain points. But during that period what we could find, suggested that the fossil fuel industry had spent over $1 billion over the course of just five years to influence public opinion on these issues. And that outweighed the clean energy by a factor of 400 to 1. So, there’s just no competition between the two. That said, I think Christine is exactly right that this is changing and there's a few reasons why. One, everybody knows that this is where the future is headed. And if advertising and PR is about anything it’s about trends. It's about predicting the market, driving the market and everybody's clear that the market is moving away from fossil fuels to clean energy. Second, those are the companies that people want to work with. If you go to the main PR and advertising agencies around the country and around the world. Hardly any of them put their fossil fuel clients on their website. And if you're not proud enough to put your client on the website, maybe you shouldn’t be working with them. This isn’t a work that people are happy about or proud about or that is attracting talent and winning awards it’s kind of the dirty secret that maybe keeps the lights on. So that's saying something about where the industry is going. And finally, it's not just clean energy companies that are part of this new economy or have something at stake in this conversation, it's also huge consumer facing brands that are trying to convince their consumers that they are committed to sustainability and wanna be part of a more sustainable economy. So, if I’m a brand like Unilever and I'm trying to convince my consumers that I care about the climate, I care about the environment, do I really want to work with an advertising agency that is also working with ExxonMobil to block climate action to put out propaganda about my product? That just increases the type of distrust that is destructive to brands. And so, I think that conversation is one that we’re really trying to have with major companies that might not be involved in clean energy but do have a stake in this conversation to say hey, just like you take a really close look at your supply chain to figure out whether or not the products you are sourcing are sustainable. Take a close look at your advertising firm and ask them if they're working with clients that are really aren't aligned with the mission and the values that you’re trying to put out there in the world. And I think that's beginning to happen. I think again this has been a sort of sector that's avoided the type of scrutiny perhaps not surprisingly, because they're very good at shaping public narrative. But it's something that's beginning to really take effect and I think in conversation that’s only going to expand in the years to come.

Greg Dalton: So, as we wrap up, what’s the next chapter in this Christine, what do you think the next term will be that you’re looking for trying to make happen?

Christine Arena: The next term is I think, you know, accountability. I think we’re seeing a wave of accountability journalism. I think we’re going to probably see some PR firms and executives specifically called as witnesses to testify at the oversight the House hearings on climate disinformation. I also think that we’ll probably see a lot of activity on the state level those lawsuits, the state AG lawsuits filed against oil firms for their deceptive advertising. I think that we’ll see some of the marketing partners named as defendants in some of those suits. And I think we're going to continue to see this wave of public interest and curiosity about this issue because climate change is something that everyone listening and everyone in the world is experiencing on some level.

Greg Dalton: Jaime, Martin Sorrell is like one of the gods of the advertising industry. He's made some moves recently. What does that told you about the way the winds are blowing in PR and marketing?

Jaime Henn: Well, I think it's a good sign and for those who don't know Martin Sorrell is one of the early kind of leaders and founders of WPP which has emerged as one of largest advertising firms in the world and he's now started a new company and one of the first steps he took was to sign the Amazon climate pledge and say that his agency was really going to focus on this. Since then, the details have been a little scant about what exactly that means. So, there's some accountability work that needs to be done there. But the point is that this is clearly where the market is headed. You are not gonna be an advertising agency in 2030 and not have a position on climate change. There is a parallel with big tobacco here, however imperfect. And I think people need to look at themselves and ask what I've been proud of working for Phillip Morris to block action to address cancer from cigarettes. You know would I have wanted to have been on the account that put out the lies about that. And if the answer is no, then you better ask some serious questions about the work you're doing for the fossil fuel industry right now. Because the level of anger that people feel towards those companies today is only going to magnify as the impacts of climate change become more clear. We need those creative minds working for the good guys instead of putting out propaganda for Exxon.

Greg Dalton: Thank you so much for coming on Climate One.

Christine Arena: Thanks for having us.

Jaime Henn: Thank you.

Greg Dalton: Lastly, it’s fair to admit that these issues are complicated and changing. Years ago, Climate One did accept funding from major oil companies. We no longer do.

Greg Dalton: Climate One’s empowering conversations connect all aspects of the climate emergency. To hear more, subscribe to our podcast wherever you get your pods. Talking about climate can be hard-- but it’s critical to address the climate emergency. Please help us get people talking more about climate by giving us a rating or review. It really does help advance the climate conversation.

Brad Marshland is our senior producer; Our managing director is Jenny Park. Our producers and audio editors are Ariana Brocious and Austin Colón. Megan Biscieglia is our production manager. Our team also includes consulting producer Sara-Katherine Coxon. Our theme music was composed by George Young (and arranged by Matt Willcox). Gloria Duffy is CEO of The Commonwealth Club of California, the nonprofit and nonpartisan forum where our program originates. I’m Greg Dalton.