Greg Dalton: Today on Climate One, we're discussing the importance of forest and the race to reduce carbon pollution that is driving weird weather in California and around the world. I'm Greg Dalton. Welcome everyone.

A tree that is cut down and made into plywood or papers included in the economy but what is the economic value of a tree left standing? Until recently, it's been close to zero. Corporations not on the paper or lumber businesses are increasingly talking about forests and how they relate to their business. In fact, the whole industry is springing up around the business of protecting forest as a way to protect the climate.

Over the next hour, we will look at forest protection with our live audience at the Commonwealth Club in San Francisco. We're pleased to have with us three people who operate deep in the forest. Mike Korchinsky is Founder and CEO of Wildlife Works, an environmental group;

TJ DiCaprio is Senior Director of Environmental Sustainability at Microsoft; and

Sissel Waage is Director of Biodiversity & Ecosystem Services at Business for Social Responsibility, a consulting firm here in San Francisco. Please welcome them to Climate One.

[Applause]

Greg Dalton: Welcome everyone. Mike Korchinsky, let's begin with you. Tell us about the overall state of the health of the world's forest and why they matter for the climate?

Mike Korchinsky: Unfortunately, forests are being destroyed at a very alarming rate, still today, probably around 30 million acres a year of tropical forests are being destroyed for one reason or another, almost always economic. And that destruction creates about seven billion tons a year of emissions. So more than the entire global transportation sector so it's a very significant contribution to the climate challenge that we face is all these emissions coming from forests being cut down and destroyed.

Greg Dalton: And that matters to the climate so the idea is that to slow the rate of destruction or to actually reseed some of these forests?

Mike Korchinsky: Initially, to slow the rate of destruction, the first challenge is they're being destroyed for economic value, as you mentioned in your introduction, so the first challenge is to provide a competing economic value to leave them standing. And the mechanisms that we're going to discuss tonight are the first attempts to create value in the standing natural capital of trees that will compete with the economic value in destroying the forests.

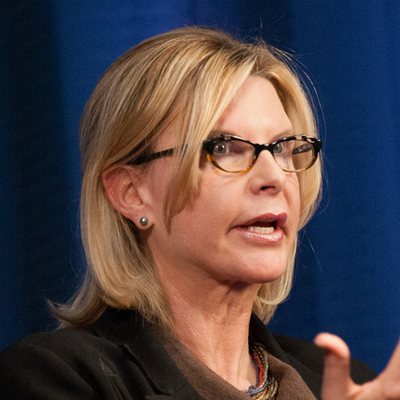

Greg Dalton: Sissel Waage, you work with companies that are some of them involved with forests, some of them not. How are companies looking at the value of a tree standing versus a tree cut down that can go into quarterly earnings?

Sissel Waage: It's a wide range of points of view obviously as diverse as companies in the world. But we've historically we have the situation that Mike described as a function that standing trees are perceived as having value once you cut them down and turning them into other values. And the reality is they actually have a lot of value standing, we just haven't built it in to how we account for nature and the economy. And this is linked to the bigger set of ideas and conversations around natural capital that is increasingly being discussed and discussed by more and more governments that are trying to and exploring through the World Bank wealth accounting for value, valuation of ecosystem services, different ways to try to build natural capital accounting methods into GDP. It's also being explored by companies that are looking at building environmental factors into corporate accounting like Puma is like Dow Chemical Company.

So we know that the value of a standing forest is not zero but that's the way we account for it in many ways. It's contested what exactly it is, depending on where the forest is, but we know something above zero and we know that forests are incredibly important not just for mitigating climate change for sequestering carbon, but also for adapting to and for enabling not just having biodiversity but the flows of water and retaining water and many other things. And so REDD is an effort to say there's many ways we can actually look at monetizing what that is worth and starting to go about accounting for a range of different both monetarily but also from an environmental stands the values that we derive.

So companies are starting to engage. There's leaders like you'll hear from Microsoft, like Puma, like Dow, like Walt Disney company, and there's more and more that are quietly listening, learning and starting to engage and I think it's — I have a colleague that recently wrote a blog that said, "You're increasingly starting to see a low carbon parade. And as a corporate player and corporate leader, you have a choice. You can join the parade or you can become a leader and call it your own parade at this point in time."

Greg Dalton: Well, we'll get back to some of those issues about Puma and the companies you mentioned and accounting and natural capital, et cetera. But

TJ DiCaprio, I want to ask you how Microsoft came to this "We Care about Forest." You're a software company with coders and used to make CDs, no longer. So I guess even probably you don't send out lots of boxes anymore with Microsoft Office. So tell us how you came to care about forests and also to — and then we'll get into the internal price on carbon.

TJ DiCaprio: Oh, that's okay. Well, you bring up an interesting point because we may not be packaging software on CDs or DVDs and sending out packages. But with our new business model and our shift to the cloud and services and devices, we realize that there is a significant consumption of energy and quite a bit of that energy that we consume through electricity and different energy sources has coal as a base and we're producing carbon. And for years, Microsoft does see that climate change poses some pretty significant challenges and so we wanted to take a look at how we operate and get our own house in order. And part of that was to say, "Gosh, we're building data centers all over the world with the increase of our own energy consumption is going really high as well as the proliferation of devices."

So with our customers, all the devices that we seem to be buying, even especially in this holiday season, you hear more and more of that, we wanted to make a statement and to begin our own journey by getting our own house in order. And so we did make a pledge in July of 2012 to be carbon neutral and really under the auspices of the Kyoto Protocol and do our part. And then as part of that, we wanted to be lien, to be more efficient and then to be green by sourcing our energy consumption with renewables. And then two, for energy that we can't offset, the carbon we can't offset, is to purchase carbon credits and carbon offsets. And that's where really we started to take a look at forests and how we could preserve forests because it's such a way to approach carbon reduction at scale and that's cutting. We've got data center energy consumption at huge quantities and preserving forests at scale as well.

And so to help with that, we put a price on carbon and we charge for accountability purposes the different business groups through our organization then we collect the funds, and we use those funds to support the efficiency and the greening and the carbon-offset project such as preserving forests.

Greg Dalton: So it's an internal tax inside the company. How hard was it to convince Steve Ballmer and Bill Gates to do this?

TJ DiCaprio: Well, the organization got behind it very quickly. We understand that internalizing this external cost of reducing pollution, carbon pollution and how we needed to take that into consideration for our own operations and the amount of good that it does. Not only does it make a business sense because it drives efficiency when you got a price signal that's associated with your operations and consumption of energy and business travel, but also we're able to then use those funds and have such an incredible impact in different parts of the world and help developing nations accelerate in a local carbon economy. And that was really a big position for us from a citizenship perspective is how can we have that impact on a global basis?

Greg Dalton: So

Sissel Waage, if this make such strong business sense, why aren't more companies doing it?

Sissel Waage: There's always a range of reasons. Martyn Bowen whose managing director at Puma of Europe and the Middle East and I wrote a piece in GreenBiz in the spring in which we said there's really — there's two key reasons. One is the very same reason I have a 21-year-old friend recently that told me she had an astonishing amount of money in her checking account and I said, "Why isn't it at least in a CD?" And she said, "What is a CD? I didn't even know there was an option." So REDD is a relatively new –

Greg Dalton: Explain what REDD is.

Sissel Waage: REDD, well, let me pass over to Mike to layout, Reducing Emissions from Deforestation and Land Degradation.

Greg Dalton: So it's a way of protecting forests. Okay. So –

Sissel Waage: Yeah. It's a way of protecting forests. It's a relatively new area of investment, investing in forest carbon and –

Greg Dalton: So you're saying companies don't know about it, they don't think about forest, "I'm making wages, forests, it's not my business."

Sissel Waage: Yeah, exactly, non-core business or I'm not even aware that it's an option. The other is there's a perception that there's risks. "I'm going to invest in offsets. I'm concerned about I'm getting more and more investor questions around my climate strategy around whether or not I'm offsetting, whether or not I'm thinking about neutrality or just decreasing. What do I do?" And you see more companies engaging.

But for them, the question is, "Well, what is more risky? Might I end up with more questions from an investment or project?" The reality is that Forest Carbon and REDD+ project, Reducing Emissions from Deforestation and Land Degradation are now 20 years old. We have 20 years of lessons and not only that, we actually have a pretty robust institutional infrastructure around that is intended to provide insurances.

So if you go through that process and you get assurances from the Voluntary Carbon Standard, the CCBA, a range of other players out there, then you actually have a fair amount of ways and opportunities to de-risk and actually engage in both significant climate mitigation opportunities but it is also an adaptation play, an investment in the communities in which you engage in many cases.

Greg Dalton: Mike Korchinsky, one reason though is that there's been some bad experiences, there had been some scams, some bad stories about, "Well, do people getting paid to do things, they would have done otherwise." Offsets have a bad reputation.

Mike Korchinsky: Yeah, I mean I think it's a new industry. So despite the fact that there are one or two examples that may be 20 years old, the great majority of the activity really started in 2005 when the United Nations decided that there might be this new mechanism that's called REDD, Reducing Emissions from Deforestation and Forest Degradation, which would allow you to quantify the carbon emissions that happen when a forest is lost. And then if you could prove that you are stopping that loss and doing it in a way that honors local indigenous rights and land tenure and respects safeguards, if you could do all of those things, then you could claim those emission reductions as an asset that you could then sell to a company like Microsoft that has done what it can to reduce its emissions but still has unavoidable emissions that it can't reduce.

So I think it's really only since 2005 that the majority of the architecture and the infrastructure has been built. And in any new marketplace, there are going to snake oil salesman that take advantage of, what somebody might have heard, the imperfection in the market. So I'm not going to argue that that hasn’t happened. It isn't happening really anymore probably for the last 18 months to two years. It really isn't happening because the rules have become much clearer and because the countries that have forests now are more aware of those rules and are more able to keep those snake oil salesmen out of the picture

So I think there was some — and this is where the risk idea comes from is that there were some bad experiences four or five years ago. But we really don't see that happening anymore in the REDD industry and I think it's evolved like any industry to be more mature and it has de-risked significantly and that is now making more companies look at it. Because if you can imagine the risk issue is, "I'm a company and I think I'm doing something really good for the world. I'm investing in a community to help them protect their forest against economic threat." That's really what this is about, "How do I help a community that wants to protect their forest against economic threat to earn some money from protecting their forest." So I think I'm doing something really good.

But if I read those stories from five years ago, I'm worried that I might be giving the money to the wrong person, that story might blow up on the New York Times. And now, instead of doing something good, I've done something that's harming my brand instead of helping my brand. So the risk issue was a very real issue historically, which did stop a lot of companies looking at that. But I think now, with the advances that had been made, especially with the UN recognition of REDD now as a formal mechanism which happened very recently here in Warsaw at the Climate Conference, I think that risk has reduced dramatically. And as a result, the benefits now far outweigh the risks.

Greg Dalton: TJ DiCaprio, some people would say that Microsoft ought to go after coal in the United States or clean up the power plants in the United States rather than something that's so far away, that people are suspicious of companies doing things in faraway lands. Well, we're not quite so sure what's going on and wouldn't it be better for Microsoft, Google and others to sort of clean up the power grid in the United States. Wouldn't that be more direct and help here more at home?

TJ DiCaprio: Right. Well, and it's something that actually Mike and I were talking about a little earlier today and that is we can do both. We can support the supply and demand of more renewable energy in the United States and globally.

And we can also because of the market maturing, the level of professionalism, the amount of standards that have happened; we can also invest in these communities that are in different parts of the world. And I think the key here is because a few years ago, we were very concerned about the legitimacy and the integrity of investing in forest projects and it was actually when we got to know Wildlife Works that we were able to say, "Okay, several things have changed here and I think it's a two-pronged approach."

Number one, you need the standards and you need the recognition now even from the UN on these approaches of standard asset. And then secondly, you need to work with people that have the project developers that have people on the ground that work with the communities that do not take land away but they work with the tribes, and the chiefs, and the people on the ground where the money actually goes to the communities that they build so that not only are the trees protected and planted, but also these communities can then build themselves up and have education. They can build jobs for themselves and build sustainable communities for themselves and that's where we see really in different parts of the world our ability to have scale and to reach out in these different parts of the world and have such a big impact.

Greg Dalton: So it's not eco-colonialism where people are coming in and say, "Well, we cut down our forests in Europe and United States, so don't do that. We're here to help you do it differently." Has that ever come up, Mike Korchinsky?

Mike Korchinsky: I mean in articles, you occasionally read that idea but I think that in the end, it comes down to does the community have the free ability to decide whether this is an idea they like or not? And if you're a good actor in the space, you make sure that the community has free — it's called free, prior and informed consent. They know what they're getting into and they have the ability to say yes or no, and I think they make their own decision, whether they be an indigenous group in the Amazon or whether they be an African village. They make their own decision about whether what you're offering them is a deal they like.

And I think our experiences, it's not one size fits all, that some communities are want to be involved in a transaction where they can get paid for protection of their forest and some communities don't. And I think that — but I think one of the things that the great majority do, interestingly because for one reason or another, forest communities tend to be very impoverished, and they tend to be in remote areas, they tend to lack all the services so they are looking for help.

And so if you're a good actor in the space and you're transparent with them about the potential help you can bring, they make their own decision. And in general, we find they are positive about this idea and that they see it as a real opportunity to bring investment into their community to allow them to go down a nondestructive path, to allow them to invest in the necessary infrastructure of a community that would then support green development for a green development pathway for them.

Greg Dalton: I remember a couple of years ago in a climate talk that there was lots of pessimism about not much traction but forests were actually one of the bright spots, one of the success stories, and Brazil often gets talked about because of the Amazon. So let's talk about Brazil and what they've done with the deforestation of the Amazon. Have they turned it around? Has it slowed down that rate? Either Sissel or Mike. Sissel?

Sissel Waage: Yeah, I mean it's obviously there's a complicated set of factors there and I think it highlights that the state of play with deforestation in Brazil highlights why forest carbon projects and REDD projects are so important, which is that right now, there is a very interesting big deal around the REDD project that an indigenous group, and so are we, have engaged in a group called, for which I used to work for, Forest Trends helped and worked with them to put that and they just sold offsets to Natura, a Brazilian cosmetics company. Many, many hectares of forest in Brazil are also are under threat for all the different factors that Mike talked about but also now increasingly due to a set of dynamics related to climate change.

There's been drought. There's been huge cataclysmic fires. There's been pest and this is not unique to Brazil. This is happening in the U.S. This is happening in Europe. So you're ending up with these conflagrations of fires and huge pest infestations, which we've seen throughout the west as well. As a result of a history of changing the management, as a result of changed cycles of precipitation and drought, and it highlights the dynamics that if we don't think about forest and maintaining forest and the importance of forest in terms of natural capital, we're going to have increasing problems.

In most kind of basic level, we will have unintended release of carbon at massive scales as per the fires we've seen in Brazil for the past few years. And that's significant so it kind of leads us back to thinking about, "So how do you invest in restore and maintain forest?" REDD is again one of the tools at our doorstep.

Greg Dalton: Mike Korchinsky?

Mike Korchinsky: I mean I think Brazil is a fascinating case study. Firstly, Brazil has 540 million hectares of forest, more than three times as much as any other tropical country on the planet. So the scale of their challenge –

Greg Dalton: Hectares be?

Mike Korchinsky: I'm sorry two and a half times acre so over a billion, 1.2 billion acres of forest, of tropical forest so more than three times as much as any other tropical country so they dominate the conversation about how forest protection might happen. But a great amount of that forest is really unthreatened by man at this point because it's so big and it's so remote and there are very relatively few people, mostly indigenous, living in those forests who are not the threat to the forest. So a big chunk of their forest is not under threat. Now, it's a huge forest so the edge is huge and so the pressure on the edge is enormous even relative to any other country and threat other countries have.

So they did experience a significant decline in their deforestation rates over a five-year period. What they're realizing now is that five-year period coincided with the collapse of beef and soy commodity prices. So the demand globally which was driving the conversion of forest into cattle pasture and soy went away for five years and therefore their deforestation rate declined dramatically. What they're seeing already because they're very good at monitoring so they have the best monitoring systems, monthly monitoring of their forest, they’re already seeing that kicking up again as the global economy recovers.

So they're realizing that they didn't create a permanent solution to the problem with the measures they put in place and our argument has always been, in the end, the permanent solution is working with forest communities. They are the — eventually, you have to solve a problem for forest communities to make sure that the forest communities want that forest to stay and are going to benefit economically in keeping their forest intact. And I think that the Brazilians are now starting to realize they can't just make legislative change, they actually have to go and invest in activities in forest communities if they want forest communities to choose not to go down soy or cattle path when that opportunity does present itself again.

Greg Dalton: Indonesia is also a big country big player. You often hear about the smoke and the haze in Southeast Asia and a lot of that is burning. So is there hope in Indonesia or is a pretty dire situation, Mike Korchinsky?

Mike Korchinsky: I'm a hopeful guy. There's always hope. So Indonesia is another interesting case, 90 million hectares so 220 million acres of forests so a large forest estate, the third largest, Brazil largest; DRC, the Congo in Africa the second largest; Indonesia the third. So it's a very significant forest country. It had the highest rates of deforestation. Most of that deforestation was for palm oil, which is a very innocuous palm that's native to Africa that was introduced into Indonesia because the growing conditions were great and it's used in almost every product you can imagine for food.

So any mass-produced cookie or baking product is going to have palm oil in it and that palm oil, more than likely, came from destruction of Indonesia's rainforest. So there was a massive conversion of forests in Indonesia over the last 20 years. They've recognize that that is completely unsustainable even for their own economy so they're doing their best to try and stop that. They're investing a lot. There's a lot of countries like Norway that are helping them investing a lot of money so there is hope that they're the turning corner and that they're, for example, supporting initiatives like the sustainable palm oil, which requires that palm oil sources be identified as not having come from formerly forested areas.

And so there are lots of initiatives that are helping Indonesia but Indonesia is a particularly challenging place because palm oil is a very lucrative agriculture crop for even for small-scale farmers. So to create a competitive alternative to that that doesn't involve destroying forest is very difficult and I think will remain a challenge in Indonesia now that they've seen — individual farmers have seen how much money that can be made from 10 hectares.

Greg Dalton: Sissel Waage, there's been pressure on international food companies to change the sourcing of palm oil because some consumer work I heard recently about a campaign by environmental group so it opened up. There's a video where someone opened up a Kit Kat and there was like an orangutan finger in there instead of the chocolate. Pretty hard-hitting stuff. Is that affecting corporate consciousness and behavior on palm oil?

Sissel Waage: The reality is, again, it's hard to talk in aggregate about all companies, particularly agricultural companies.

Greg Dalton: So let's say Nestle.

Sissel Waage: Well, I can't speak for anyone. I can't speak for Nestle but we are seeing more action from and concern both behind the scenes and conversation and companies engaging with the roundtable, for example. There have been also critiques at the roundtable. Greenpeace came out with a pretty hard-hitting critique about a month ago as well.

So it is an area that is ripe for a lot of critique honestly and I think it's a challenge for corporate leaders to actually look and critically think about what does this mean for supply chain management? And I do think that taking those issues seriously and not having — trying to get ahead of it, not having a burning platform, so to speak, ignite is key. We are seeing more and more companies starting to say, "These issues could ignite more and more literally and figuratively." But increasingly, engagement is there but it's not at the level it's going to need to be honestly.

Greg Dalton: And what gets it there? Is it real risk concern by CEO saying, "We really have consumer problems with our brand or that there's some revenue concerns that prices might go up." What drives it out of the sort of the corporate sustainability person who sort of manages community engagement into the real power center of the company?

Sissel Waage: Well, yes. I mean it's as diverse as the leaders of the companies, which every time we'll go in and work with a company, somebody says, "You have to understand my CEO is really unique." And I say, "Oh, how unreasonable." That's the case everywhere but risk is enormous. Supply chain management is an enormous issue, whether or not brand and reputation risk is absolutely huge and hugely of concern but it's a very competitive marketplace as well. So, people looking at cost of inputs and their recipes and a range of other factors there. So I think the biggest trend I see though is that there is going to be more scrutiny and more pressure on companies about understanding their supply chains and understanding their unintended consequences.

And the social media that kind of — this is just the tip of the iceberg and the ability of good guide and a range of other players to kind of peel back the current and know what is in this ABC piece of food or shoe or whatever I may pick up and be able to scan it with my smart phone and my iPhone and start to find out. So it is a real lesson in understanding your consequences and your impacts all the way through your supply chain, even through tier 1, tier 2, tier 3 and what it might be doing to, again, things that are far beyond your domain of usual controller accountability.

Greg Dalton: Which kind of comes around back to Microsoft.

TJ DiCaprio, have Microsoft shareholders benefitted from a carbon tax at Microsoft?

TJ DiCaprio: Oh, absolutely. One of the funny things Sissel just mentioned about having a device to show the transparency of the impact of the supply chain and I find that looking at technology, there is the plus side too while technology also consumes a lot of energy and keeping our devices going. It also promotes that transparency that helps us be responsible.

And, Greg, getting back to your question, absolutely, we're driving efficiency. I think that it's an interesting way to look at the issue, does the carbon fee drive responsibility or can we also look at it as Microsoft is well managed and therefore managing its business, being responsible and demonstrating responsibility with the carbon fee and therefore, it is being responsible to its customers. So yes, the carbon fee drives a price signal, which helps us drive efficiency. We also promote the supply and demand of renewable energy. We also have impact globally at scale to help solve this big problem of climate change by supporting the preservation of forests and building communities and accelerating the development of a low carbon economy in emerging nations.

All of that is to benefit our customers and does the carbon fee drive well-managed company? Does a well-managed company implement a carbon fee? And I would argue for more corporations to consider this very simple model is being a well-managed company, how can you not have the type of carbon fee that actually internalizes the cost of offsetting your pollution and driving that type of accountability and efficiency through your company.

Greg Dalton: I remember a colleague of yours, Rob Bernard from Microsoft, was here a couple of years ago and he talked about how, for the first time, the people running the data centers had to pay the energy for the energy bills for those data centers. They used to be like, "Yeah, let's get the biggest servers we can, right?" And they never paid the bills. They start paying the bills; they start thinking, "Oh, well, no, let's think about these servers and what we do." So the question is whether — also you mentioned corporate travel, so do Microsoft fly a lot less?

TJ DiCaprio: Well, we are seeing different levels. I think there are lots of different variables that impact, especially corporate business travel. But now what's nice about it is in our tool that actually when you go into plan your trip, it actually shows you the carbon amount on your trip as well. And even now what's happening, as we see this price of carbon being involved or taken into consideration now for our long-term planning.

So the data center folks or our business groups say, "Gosh, I'm going to buy so many servers." Well, now, that cost of carbon is actually incorporated into their long-term financial planning on the cost of that server. So it's not only the energy they're paying for to the utility or where we pay the energy bills, but it's also that price we now have to pay to offset the carbon that's associated with running that server in that data center.

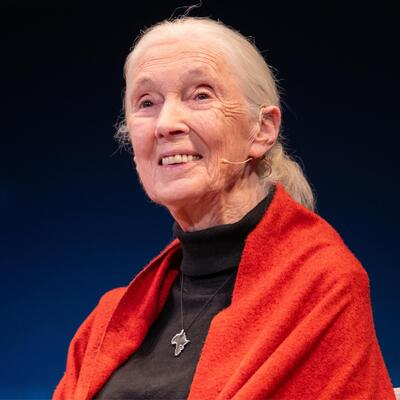

Greg Dalton: If you're just joining us, we're talking about forests and climate change at Climate One. I'm Greg Dalton. Our guests are Mike Korchinsky is the CEO and founder of Wildlife Works;

TJ DiCaprio is a senior director of Environmental Sustainability at Microsoft; and

Sissel Waage is with Business for Social Responsibility.

TJ DiCaprio,

Sissel Waage mentioned earlier that Puma has done a lot in terms of accounting for its environmental impact they did an environmental profit and loss statement that said, "If we were to account for all of the environmental damage in our operations, here's what our profit would be." Would Microsoft do the same thing?

TJ DiCaprio: Well, I think we're setting the stage for that now because it's pretty exciting to see all the great things that we're doing now as a result of actually having that price on carbon tracking all of the good things that we're doing and it also gives us a way to level the playing field. Because when we start to take a look at carbon in terms of dollars and it infiltrates the whole financial structure, we actually have a view now into the business and into our ability to demonstrate environmental responsibility that we never had before.

We also have because we invest in internal efficiency projects, we have efficiency folks from all over the world in our different subsidiaries coming forward to us saying, "Hey, on those carbon fee funds, can we use some of those to do to accelerate this project that we may not have been able to do because we didn't have it in our original financial planning?" And so we're able to have that view and that transparency now on the impact that in demonstrating environmental responsibility has and it's really by putting that price on carbon and integrating it into the financial structure of the company that's highlighting some of these pretty incredible things.

Greg Dalton: Sissel Waage, what's been the impact for Puma doing that and if others followed?

Sissel Waage: Well, I think the headline just precede the answer. I mean it's a really important moment in time to flag that these are companies that are starting to actually internalize what have been historically called environmental externalities.

Greg Dalton: Pollution may push off on somewhat else –

Greg Dalton: — onto the pump.

Sissel Waage: Yeah, that is very significant. And David Batker who's the founder of Earth Economics out of Seattle talks about the importance of this need starting to and needing to happen more and more at this moment in time because — and he likens this moment in time that we're in facing climate change, facing massive species extinction, facing deforestation as very similar for environmental natural capital reasons to the financial capital crisis at the moment of the Great Depression.

And what he says is that, "What the Great Depression told us about accounting and there's this analogy here for what we're learning about accounting is that we were focused on the wrong variables, right?" The Great Depression was fundamentally about banks were excellent at tracking their internal micro lending, whole lot less good at tracking their lending across banks, and that's why many people did not see the Great Depression coming, right?

So we have been very, very good at engaged in a range of different ways in which companies account for profits and losses. We have been a whole lot less good at understanding how countries, companies, a range of other players impact the environment and nature, and that's why, all of a sudden, we're facing things like climate change, species extinction, water scarcity issues or range of issues. These are the externalities now coming home to roost.

So what's really interesting, you have someone from Microsoft sitting here and TJ is saying, "We're internalizing that externality, one of these externalities." You have Puma saying, "We're going to internalize this full suite," and then saying, "Well, there's not really a corporate accounting structure or approach to do that so we're going to collaborate with true cost in order to develop that and then we're going to put it out there for peer review."

So what's fascinating and then you have more and more companies looking at this, and again, quietly starting to explore. I've heard more people saying to us behind the scenes yes and the next year, two, three, "We're going to be developing an environmental profit and loss." And then what's going to happen that's going to be really interesting again for the Forest Carbon and REDD community is you're going to see companies with an astonishing amount of environmental losses. Our impacts to produce and move our products are jaw dropping and they're going to be faced with increasing pressures to become more efficient and effective and say, "Okay, how do we shift those losses to profits? One of the ways, again, is you start thinking about offsets and investments and things like Forest Carbon and REDD+ projects then.

Greg Dalton: Has that affected Puma's stock price? I mean what tangible economic benefit has Puma realized so far? Is it they're just seen as a leader, brand leader? Their chairman, Jochen Zeitz, was very personally committed to this but that's soft and maybe squishy but maybe not. Are there other tangible business results that Puma has achieved?

Sissel Waage: Yeah, I can't. I haven't looked specifically at that and you may be closer that they've gotten brand lift seems very, very clear to me.

TJ DiCaprio: Maybe a little bit from Microsoft is what we see is, again, the driving — because there's a price signal, is we do see the focus on driving efficiency when you got another cost setup to include in long-term planning. So if I break it down, there's two points. There's reducing the risk to margins by cutting cost and even from a travel perspective suddenly, again, technology can be the benefit here because we've got collaboration technology that we can use in many ways so that we don't have to get on a plane and go across to Europe or have these meetings or even commuting to work. We can work from different places and we actually get on the phone, you've got the audio-visual et cetera so –

Greg Dalton: Oh, you bought Skype, good. Yes, exactly.

TJ DiCaprio: So the technology can help you reduce the cost and that's one element. And then as well it's reducing the risk of revenue. How can we deliver enough benefit to our customers so that our customers realize that we are managing our business, we are driving discipline and accountability in how we manage our business and how do we deliver value to our customers so that our customers want to buy Microsoft cloud services and devices. So there is a way to look at it from a financial perspective or it's talking about again reducing the risks and reducing the risk to margin and revenue.

Greg Dalton: And in those conversations, do you talk to people who either doubt or dismiss climate change? You're talking very — you just make a business case and you care. Does climate even come in to it or maybe not?

TJ DiCaprio: Well, I think that climate change is such a serious challenge that it's understood that if we keep it tied to business, then we get back to the supply chain and what are the impacts on our business? What can we do as a global citizen to be able to help mitigate any type of consequences that are currently happening from climate change? So it just makes a real business sense to reduce the risks.

Sissel Waage: For most people in business also, again, the conversations vary different company to company. But what is not disputed is that all these environmental issues, this is like gravity. I have a colleague that used to say, "You can be an engineer and choose to wake up every day and say I'm going to design a bridge but not think about gravity." Your bridge will fall, right? And so it's full hearty so you wouldn't do that but that is what we affectively have done in many ways with the lack of thinking about environmental impacts with many design and structure of our supply chains and many of our businesses.

And increasingly, business leaders are looking at those impacts, and again, climate change is one and deforestation is one. An understanding like this is like gravity and so while it might not be able to describe the exact nature of the impacts, its clear there are going to be impacts and it's clear they're going to be nasty and adverse, and it's clear they're going to also affect my company.

Greg Dalton: And risk.

Sissel Waage: And significant risks. And so then the conversation gets very detailed for particular companies and supply chain, et cetera. But we're at a moment in time where it really is akin to gravity you don't dispute anymore the relationship. The discussion and the dispute is more like how when and where will it affect me and therefore, how do I rank and prioritize actions and what do I do underneath the table quietly so that people don’t say you're not doing enough or you're not engaging, et cetera.

And so what's interesting is we see more and more companies engaging quietly and I wish more companies would come out of the closet, so to speak, and talk about what they're doing. There are concerns, in many cases, that, "Okay, we only are sourcing X percent organically," and what about the rest of it? Ten percent, that's inadequate, et cetera. And then they're concerned that they're going to get a critique, for example.

Greg Dalton: Whatever they would do, it won't be good enough. Mike Korchinsky, do you want to get in this?

Mike Korchinsky: Well, I was just going to give a commentary because I know Jochen Zeitz and I think so initially the impetus there was a very strong personal belief that it was the right thing to do that the future of corporations is that they will have to account for it. That is the right thing to do for them to account for the externalities within their business and so it started with a personal conviction and he was in a position of authority that he could then figure out, "How do I move that into my own company as an example?"

And I think the old business adage that if you're not measuring it, you're not going to manage it is where you started, which if we're not measuring these things, how are we going to manage them and how are we going to change them? So step one, let's measure them. Let's measure energy use. Let's measure emissions. Let's measure water use, the major environmental impacts, toxins that we have so we can see what the impact we're having is and then we can decide how they fit our business and whether or not because using water has a cost. You pay for water in most parts of the world using energy as a cost. So each emission you create has a cost.

So once you see where it's happening in your business, then you can start to manage it. And I think so his first thing was came from a personal conviction but he quickly realize that we need to create a system where companies are measuring and looking at the results before they can actually start managing. And then each company will make their own decision about how they manage it, how aggressively they offset or they pay the economic cost today. And they had those issues at Puma about, "Gee, are we going to be criticized?"

And in his mind, I have to say Patagonia was always the landmark company that he used in his mind because Patagonia, many people love Patagonia and they're extremely loyal to Patagonia because they tend to always do the right thing no matter what it says about their business. They'll admit they're using toxic stuff in some of their products. They'll say, "Here's our product. This one is great, it's organic cotton. This one, not so good," because in order for us to give you a functionality you want, we're having to use these nasty things in it but we're trying to figure out how not to.

And so his benchmark was always, "Gee, if Patagonia can get away with doing that," and people applaud them for being honest about their shortcomings, why can't we?" And so get the information out there. Be a leader in getting it out there and then let the marketplace decide whether you should be applauded for that or not.

Greg Dalton: Patagonia has some luxuries though as a private company, they have some things — some latitude that other companies don't have. And actually, Rick Ridgeway was here from Patagonia recently and he's not so keen on organic cotton because it uses lots of water or it's great on the pesticide, et cetera, but it still uses lots of water. So let's talk about water.

Sissel Waage, Coca Cola, Pepsi Cola India, there have been some really celebrated cases of companies getting into very sticky situations because people are starting to realize how much water is used to make a can of Coke. So let's talk about water risk invulnerability for them.

Sissel Waage: Yeah. And I think the best way again to kind of situate this in your mind issues around water scarcity is another manifestation of an environmental externality issue. I have a colleague who calls at and he works with financial services sector players and he talks about ecosystem malfunction risk and ecologist. I was like, "What does that mean?" But what he's signaling is that and what Coke experienced in 2005 in Kerala, India when they had to shut down their bottling plant under considerable questions is the most gentile way to say it but concern around water — both quality coming out of the plant but also quantity usage.

And even though they were able to bring in many, many scientists to show that they were using a different underground aquifer from which the local villagers were drawing upon to do farming, there still was a gap between and concerns around perception in water use, and drought, and scarcity. And the reality is companies face — there's multiple licenses to operate and Jeff Seabright of Coca Cola has talked about that a lot that there is the actual physical license to operate that you have to receive but there's also social license to operate. And then there's also license to operate like is the resource there and available.

And in 2005, in Connecticut, a nuclear power facility had to shut down because the temperature of the ocean water was higher than that which was prescribed to cool the nuclear power facility. Our players in the financial services sector or our companies reliant upon that power factoring in this kind of ecosystem malfunction that is, in that case, has a function of climate change and warming summers increasingly going to happen. "Are you thinking about risk and due diligence in a way that is encompassing both the ways and the impacts and dependencies you have on normal structure and function of ecosystems?

And the answer for many people in business is, "No, I don't even know what they are." So you have a growing number of players. World Resources Institute has put out different tools the Ecosystem Services Review. We at BSR work with companies on a range of these issues to say, "Do you understand your impacts and your risks and dependencies? Do you understand — and are starting to perhaps think about investing in the restoration, maintenance and function of the ecosystems which you rely which then get back to REDD." So if you're working in an area that really depends on a normal maintaining ecosystem, maybe you should think about investing it.

Greg Dalton: Whereas in the past, companies are just managed inside their friends, right, inside where their water comes from. They don't manage the hill, the forest upstream, outside where they — Mike Korchinsky?

Mike Korchinsky: They're starting to. I mean I think Coca Cola is an example where in Southeastern Kenya, their bottling plants are at the coast. All that water comes from a very small cloud forest in a national park and that very small cloud forest in a national park is 200 miles away from their bottling plant is under extreme threat for a conversion for very low economic value. And so they're starting to recognize that, "Gee, our business — the sustainability of our business is threatened if we don't start thinking about where this water is coming from." And there are, of course, the social issues of how much are they allowed to take versus the rest of the community and all those issues are managed fairly well because this is a pipeline that provides very — currently still very large amounts of water but they can see the trend.

And if that forest disappears, then seven million people at the coast will be without water and Coca Cola has the potential to help solve that problem because they are the most — one of the larger economic beneficiaries of that flow of water that is currently being captured by the cloud forest.

Mike Korchinsky: And retain their access to the water and everybody else has access to the water in the coastal community. And there's another example of tea, tea production in Kenya, where the rainfall is not what it used to be and it's not — so the tea growers are now starting to realize, "Holy moly, we better figure out why that forest is being cut down and what we can do to stop that forest being cut down because our local rainfall is being affected by local climate change because of that forest being cut down."

So I think businesses are — you can argue that they're doing it out of self-preservation but better there than nowhere I think and I think that's one trend that we're really seeing is that companies are starting to realize that the definition of sustainability for their business means access to the resources they need to be in business in the future. And if they don't ensure that they're doing whatever they can to make sure those resources are available, then they're threatening their own sustainability.

Sissel Waage: And I think the best analogy though and that is any company that is using the Panama Canal, for example, to move their cars or their shirts or their jackets or whatever through the Panama Canal, they pay money to the harbor master, right? And the harbormaster makes sure it's dredged and there's steep slopes and there's a lot of erosion due to deforestation around the Panama Canal. But that you pay for and you pay the Oakland Harbor and other harbors. And you expect, in exchange, that when you arrive, there will be someone there that will get your stuff off but yet we don't pay to maintain that cloud forest, which is key for maintaining the structure and function of recharge of the underground aquifers.

Dow Chemical Company recently did an analysis with the Nature Conservancy and they're public, it's available online, looking at investing in green infrastructure instead of water filtration plant and the economic — the delta was hugely beneficial to just invest in the green infrastructure and the ability of a well-functioning area that can filter water is actually enormous. Again, there's a famous case out of the Catskills of the same but it's getting at this bigger set of issues around companies rely on built infrastructure and green infrastructure. We just haven't talked about the green infrastructure.

Greg Dalton: Tony Juniper is a British author who was here recently who said that, "The economy is a wholly-owned subsidiary of nature, not the other way around."

TJ DiCaprio: Your discussions highlight something that I think is quite an opportunity and that's the delivery of innovation. Because when we take a look at these situations, how can we suddenly understand, "Here's a situation I need to fix and then how can I innovate to meet that need and make a difference?" Rolling it back into Microsoft's instance when we took a look at from energy consumption perspective, one of the things that we're taking a look at and also using the carbon fee funds for, how can we start to generate and use and consume renewable energy by using methane or building our data centers and having them be near ranches so that there's a put to power.

And how can we start to develop new ways that we can consume energy, what are new ways from a technology perspective that we can power servers on the blades and in the data centers in ways that are much more efficient and consume less energy. So I think often you'll see a much — a big improvement and a drive and a push for innovation because of these situations.

Greg Dalton: I've heard about data centers one day without walls because so much of the data center energy is cooling, right?

Greg Dalton: So let's have our audience question. Welcome to Climate One.

Louis Blumberg: Thank you. My name is Louis Blumberg. I'm with the Nature Conservancy. I want to thank the panel for the great presentation and the only forest war I'm hearing, Greg, is really coming from your chair but let me start with a comment and leave and end up with a question. I want to draw this a little bit closer to only here in California. Just last month, there was a study from Princeton University that showed if all of the Amazon forest was deforested, the snowpack in the Sierra Nevada would be reduced by 50 percent. So what happens in the Amazon, what happens in tropical forest affects our water right here in California.

And the point or the question I guess I want to lead to is around market's voluntary action. And just last month, California approved the first compliance-grade forest carbon credits from projects within the United States. So this talking about minimizing risk, now we have in California a model for a carbon credit that has the faith and backing of the state of California. So this is really the best way to reduce risk that I know of is having a compliance-grade credit.

So my question to the panel, there's been some great information about voluntary action, corporate best practices, people really reaching out to try to make this happen. Do you think that we can achieve the scale that you've talked about by continued voluntary action by the business community and nonprofits or do we need some kind of global carbon market? And if so, how are we going to get that?

Greg Dalton: Big question but

Sissel Waage, let's start with you. Is voluntary enough because you work a lot with corporations trying to get them to do more than what they have to do?

Sissel Waage: No. My personal opinion is voluntary is definitively not going to be enough, not only because of the magnitude of the issue but also the rate. This is the decisive decade. You talked to every single scientist, particularly climate change scientist but also forest, this is the decisive decade. So the set of issues and the rate that we have to start addressing things at a significant really out scale, so it would be wonderful.

I mean, again, there's a range of different options that I will say from a personal stance that I think are incredibly important from carbon taxes through regulation. My response is it's got to be all of the above and it's a matter of — it's a challenging political climate. We are privileged, in some ways, to have a different political climate here but we need all of the above and we need it quicker and much more significant action.

TJ DiCaprio: And why not move into voluntary action instead of waiting for some type of regulation to happen.

Greg Dalton: Because there's a stock price, there's a cost, there's a stock price, there's –

[Applause]

TJ DiCaprio: It's really simple and so let's not wait, let's –

Sissel Waage: But the reality is there is a dynamic. They're actually the reason a number of companies are engaging is they think it's only a matter of time before either there's some sort of regulation or investor mandates or there's a range of pressures and they feel like, "Okay, I'll use engaging with REDD as my initial step to learn and understand and develop competency."

Greg Dalton: So

TJ DiCaprio, Bill Gates and Warren Buffett are trying to get people to give away half of their wealth. They're calling people up and twisted arms on a telephone. Is Microsoft going to other companies and say, "You got to — you should have a covered tax, join us."

TJ DiCaprio: Right now, yes, absolutely. Yes, absolutely and we will be coming out with a guide in order to talk about what our carbon fee is, why it can be beneficial to other organizations and then how to implement one. So there's really nothing left except to say, "Gosh, let's get going. Let's not wait. Let's take action."

Greg Dalton: Because Wal-Mart has used its corporate power tremendously to get other companies –

[Applause]

Greg Dalton: — to follow its suite and let's have our next audience question. Welcome to Climate One.

Anita Mitrova: Anita Mitrova. I'm a researcher from UC Berkeley and my question is this, as REDD credits are becoming more and more mainstream tradable commodity, they start competing with carbon credits from non-forest projects. For example, a pig farm in China yet forest credits have a lot more benefits than just conserving carbon. They're beneficial for biodiversity, for water conservation for developing and enabling the livelihood of local communities, and I'm wondering if these additional benefits would be reflected and can be reflected in the price of carbon credits?

Greg Dalton: Mike Korchinsky?

Mike Korchinsky: As we sell carbon credits, I'll take that one. So I think the first piece of that, the answer is that in a voluntary market, prices, willing buyer, willing seller, so there's no question that in a voluntary market, forest carbon credits get a higher price, no question. Because of the added values that are of real value to the buyer, to the corporates that see those benefits and their co-benefits is being real and tangible part of the reason why they're doing it. So I think in a voluntary market, that's the case.

There's a question in — to answer the compliance market issue, there is a question as to when things become compliance markets if carbon credits are commoditized and forest carbon credits become part of that commodity market then they will have the same price as everything else. So there is a question of structurally within the international community about whether that's the right answer for forest carbon because forest carbon is very different than other kinds of carbon. All other kinds of carbon emission reductions are an add-on to another business activity.

The pig farmer grows pigs. They happen to make a lot of methane. And if he flares that methane, he can claim some small emission reductions that give him additional profit but the bottom line is he's a pig farmer. Protecting forest is not an economic activity without the carbon value. So forest carbon is unique in the sense that it has costs associated with protecting forest that aren't met by any other source of revenue within that program.

So there is a debate about whether the right answer for forest carbon is that if it's commoditized along with all these other credits or it has a separate system with a floor price that meets the basic needs of the projects to be successful over the long term to deliver the benefits that the communities need to be able to transition into a low-carbon economy over the long term. So that's a legitimate debate, I think, and the UN recognizes that debate. I think the UN recognizes that potential dichotomy between these classes of emission reduction I think.

And so I think people have gotten a lot smarter. I don't think the debate is — there's going to be this big global mark and everything withdrawn in. I think it's going to be much more intelligent now than the context of forest. And the reason forest carbon emissions are so important, not just the scale is it's the least expensive way for us to reduce emissions at scale today. It's far less expensive for the planet to reduce emissions by protecting forests and giving communities economic benefits than it is to build a solar power plant in California or in Spain. Far less expensive. So if all we're concerned about is how do we reduce emissions quickly and cost-effectively to get the maximum climate benefit, we should be spending every dime on protecting forests and not on all these other things.

[Applause]

Mike Korchinsky: Now that's not a reality but that of course is a reality. We also need to transition our economies, our developed economies into low-carbon economy. So we need to find a balance between cost-effective emission reductions through protecting forest and making the necessary investments in renewable energy to move our economy away from creating so many emissions in the first place. So that balance is really the key for California and for the United States I think.

Greg Dalton: Mike Korchinsky is CEO and founder of Wildlife Works. We're talking about forest and climate change at Climate One. Let's have our next question. Welcome.

Raquel: Hello. My name is Raquel and I'm just a person who loves forests and understand that they are the lungs of the world. And having forest standing, allows us all to breathe and I like to breathe. So here is my question. How does protecting the forest in Africa benefit the local forest community?

Greg Dalton: Mike Korchinsky?

Mike Korchinsky: So the contract, if you like, with the local forest community is that we, as an organization and our investors, are willing to pay them a fee for every ton of emissions that they reduce. So with their science involved in figuring out how many emissions would come from a forest if were destroyed, there are rules to make sure that it really was under pressure and that you wake up one day and just think, "Gee, we'll protect out forest and make some extra money."

So there are safeguards to make sure that that these forests are really threatened. If they are, then we can quantify the value of that forest to the community and we pay them in order to change their practices. Because, really, in all human endeavor, it's never about the science and it's always about the people. It's always about how do you actually change these people's behavior from the path their on, which is destroying forest for economic need of one reason or another, to a low-carbon path that doesn't destroy the forest and getting people to want to change, you can incent that want-to-change with money because they need money for schools and healthcare and other infrastructure within their community. So you can incent the beginning of that change with money.

But in the end, they have to believe that that's the right answer for them long term as a community to leave their forest intact because eventually the carbon money runs out. In 30 years time, the carbon money runs out, they have to have made a transition to another economy that doesn't depend on destroying the forest. So they benefit directly in economic payments if they participate in protecting the forest. They benefit in jobs. We invest part of our investment is activities that will allow them to earn money in ways that don't destroy the forest.

So alternative agricultural programs that are intensifying agriculture on the existing land that they have, alternative charcoal methods so that they can create economic income from charcoal that doesn't involve destroying forest but involves harvesting sustainably shrubs and other things that they can char. So it involves finding non-land base jobs. So is there a way that we can create a small economy within their community that is not dependent on land. So the communities benefit in many ways from these programs, generally speaking in a well-run REDD project, somewhere 60 percent to 70 percent of the money goes directly into the community, and the rest obviously has to keep the government happy and the investors happy that put the money in, in the first place. So the money goes in and that's what incents them to want to move in the first place.

But in the end, they have to begin to believe that that's the right answer for them and that's the long term and that's why healthcare investments are important. That's why education investments are important because education transforms their view of the future. It transforms their view of how their children are going to interact with their environment. It gives them a way to earn money based on their skills and knowledge, rather than their hands and labor. So I mean all of these things are ways in which the communities benefit and ultimately that's what REDD is about. It's about finding that way to incent communities to want to move into an alternate path.

Greg Dalton: We have to wrap this up but I want to just close by asking each of you how you are personally managing your own carbon and water footprint?

TJ DiCaprio?

TJ DiCaprio: Yeah. First, just because I was so struck, Mike, by your comment is that it's really an honor that Microsoft can be involved with programs like that that we can have.

[Applause]

TJ DiCaprio: So thank you for your work and it is truly an honor that we can be part of that and help support making such a difference in so many people's lives and the planet. I have reduced — well, first two things. Travel, I reduced travel significantly.

Greg Dalton: Thank you for coming here today.

Mike Korchinsky: She walked.

TJ DiCaprio: With the exception I always should have to be on a video screen here. Significantly reduced my travel and that's really made a big difference for myself. And then, even with commuting, what I do is I either work from home so I walk. I walk to a local office and so I have moved my whole situation where I can actually walk to work so that's made a big difference.

And then over time what's also happened with education is I realized I need a lot less and it's really a lovely lifestyle to be free from wanting and thinking I need so much. I mean it's incredible change for me with my own lifestyle to be free and need less.

Sissel Waage: Yeah. I mean I live in Berkeley and we've happened to buy a solar house, water solar so we're lucky in that regard and I also I travel very little. Jim Collins famously would always say that, "If you want to talk to him, he wrote and built a great book

Built to Last, you come to me. So I say, "I'm just not really a famous Jim Collins. If you want to talk to me, you come to me." So I travel very little and I telecommute a fair amount. And when you look at footprints, air travel is one of the biggest ones for urban living people who have already, particularly if you're already on solar depending et cetera, et cetera so.

Greg Dalton: Mike Korchinsky?

Mike Korchinsky: Probably the biggest personal thing is I'm a vegetarian. So I became a vegetarian once I've started this quest towards protecting forest because the biggest use of conversion of forest at land is to provide meat for human consumption. So that was my first probably personal commitment. I live around the house. It's solar powered and I drive an SUV because I have four dogs and I fly all over the world to forests to try and help protect them. So I'm a big fan of somebody finding a way to fly sustainably. But as of yet, it's a bit of a contradiction in my life.

Greg Dalton: So bio-fuel is working on that and car companies are trying to get hydrogen into SUV. So anyways, all right, it's a ladder. Wherever we are, we can always do more climate next one on the ladder. We're out of time.

Our thanks to Mike Korchinsky, Founder and CEO of Wildlife Works;

TJ DiCaprio, Senior Director of Environmental Sustainability at Microsoft; and

Sissel Waage, Director of Biodiversity & Ecosystem Services at Business for Social Responsibility. I'm Greg Dalton. Free podcast of this and other Climate One programs are available in the iTunes store. Thank you all for coming today and thanks for listening.

[Applause]

[END]