Greg Dalton: Today, we're discussing the value of Mother Nature. The global economy depends on natural systems but nature often gets short changed when it comes to measuring economic output. The air conditioning counts in GDP but shade provided by a tree does not. Soil for food production and clean water for industry and human uses are also heavily discounted in today's economic thinking. I'm Greg Dalton.

Over the next hour, we'll look at the financial value of nature in a world that needs to transition away from fossil fuels that are destabilizing the earth's operating system. With our live audience here at the Commonwealth Club in San Francisco, we're pleased to be joined by two guests.

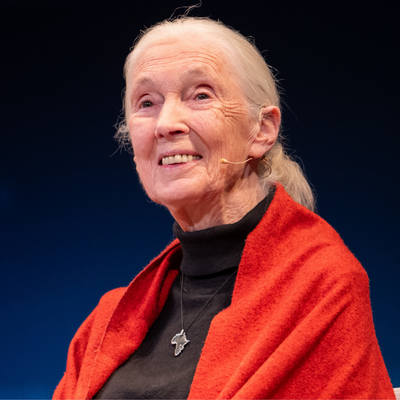

Larry Goulder is Professor of Environmental and Resource Economics at Stanford University.

Tony Juniper is Associate Professor at the University of Cambridge Programme for Sustainability Leadership and author of the new book,

What Has Nature Ever Done For Us? How Money Really Does Grow on Trees.

Please welcome them to Climate One.

[Applause]

Greg Dalton: Thank you both for coming.

Greg Dalton: Tony Juniper, tell us about this tension or trade-off between the environment and the economy. Isn't there what's good for one is sometimes bad for the other?

Tony Juniper: What I've tried to portray in the new book is what I described as the greatest misconception in history and you can see it day in, day out in political choices that are made by governments in the boardroom discussions that go on in the major corporations across the world and essentially it goes like this. The idea is that investing in nature, protecting the environment, looking after ecology; it seems a cost that is hostile to the process of improving progress, economic growth and the betterment of human welfare.

My point, based upon what I have regarded to be a vast amount of compelling evidence, shows the opposite to be the case that nature is in fact the underpinning of the global economy and in fact the economy is a wholly owned subsidiary of nature, not the other way around, and the longer we continue to see this fool's trade-off and the plunder nature in order to promote growth in the short term, the longer we are, the further we get to jeopardize the future prospects for growth because we're essentially removing the basis of it.

Because in the end we rely on soils, freshwater, clean air, the replenishment of oxygen, pollinating insects, the protection of coasts by mangroves and coral reefs, the soaking up of carbon dioxide by forests and soils. All of these things, if you start to add together the economic contribution they're making, one estimate hold is about double global GDP and yet the bit of the economy that we're measuring, the bit where we actually look at the economic growth in traditional terms, is based upon the plundering of this other part of the economy which is worth twice as much.

And so what I'm trying to do in What Has Nature Ever Done For Us? is to overturn this misconception and to generate a new narrative in economics which is about seeing nature as an essential ally in the process of the economic growth, not something that's hostile to it.

Greg Dalton: Larry Goulder, in the United States, oftentimes, environmental action is thought to increase prices on companies and consumers, and that's bad for the economy. Yes or no?

Larry Goulder: Well, it's bad if you take a narrow view of things. That is to say if you require that farmers engaged in practices that prevent nitrogen fertilizer runoff from contaminating streams or if you require that they herd cattle in a way that they weren't doing it before to prevent the discharge of waste that pollute the environment.

On a narrow view, yes, this is going to cost more but I agree with Tony. If you take the broader view and realize that what we're gaining from doing this, in particular in this example preserving water quality, we actually gain that the environmental benefits from preserving nature services, in this case water quality, would vastly exceed the cost to farmers.

So is it a bad thing? Is it a good thing? I think, overall, it's a good thing. The challenge is to find a way that these overall benefits to society can be used and discharged in a way to pay farmers for the extra cost. There's a way that you can do it so that it's a win-win. There's enough environmental benefit here. It's worth enough to subsidize the farmer's extra cost that they're know were soft, at the same time, we're better off even net of the subsidy because we have cleaner water. So there's a potential here for win-win if we're smart about it.

Greg Dalton: It really comes down to who pays the cost, right? I mean you can say socialize so people often think about what their company or they themselves are going to pay, right?

Tony Juniper?

Tony Juniper: Well, this then raises the whole question of so-called X analysis, which you'll be very familiar with as an economist and this is basically the hidden costs in a particular transaction. So for example, if I own a coal-fired power station and I am burning coal and I'm selling the electricity into the market that is one expression that the costs and prices involved in the process of generating power that way. But there's an external cost that's not on anyone's balance sheet or being paid by anybody and that is the pollution coming out of the chimney which is causing the earth's atmosphere to warm up or is causing somebody to suffer respiratory problems somewhere down the road. Both of those things have a big cost, their externalities and they're not being paid for.

So if you did start to express the full costs of different kinds of economic activities, whether it's the use of nitrogen fertilizer, the depletion of a freshwater aquifer, the destruction of pollinating insects or the loading of carbon dioxide into the atmosphere, if you start to pay for the damage that comes with those activities, then you get a radically different set of signals going into companies and I think that is part of the key to this is actually getting the people who are benefiting from the environmental damage to actually pay for the costs of that. And then some of these things they don't look too clever anymore once you start to build in these externalities.

Greg Dalton: One recent case of that is Americans – but many Americans figured out recently that their healthcare cost include the cost of people going to emergency rooms for primary care who are uninsured, and people figured out that that's – that I'm paying for that person who's going at ER. I think that changed some of the attitudes toward healthcare in the United States. But when it comes to air pollution, I don't know. Larry Goulder, has the externalities of air pollution change the cars people drive or are their attitude toward pollution?

Larry Goulder: Well, first of all, let me say that before getting on this program, I thought I was going to have to be the academic economist and explain what externalities are and everything and act as the economist. But what Tony just said about externalities was precisely what good economics would say that we have to take these extra costs into account.

Now your question, when we count for externalities, it can raise the cost. What we're really doing is we're counting for costs that are already there –

Greg Dalton: Yeah, the costs.

Larry Goulder: – that are already part of the production system or the cost of the loss of ecosystem services when we drain a wetland and convert it to agriculture land or the loss of ecosystem services when you deforest and lose the carbon storage services. Those are all very valuable things and there's a cost of losing those services.

Now if you ask, again, the bigger question, is it worth recognizing those costs? Economic analysis says, "Absolutely." Because once we recognize the cost, we change behavior in a way that we gain something here by avoiding these losses, we get more in return.

It costs us less, for example, to manage a wetland and prevent it's over depletion than it would cost us if we allowed for the depletion and loss the various services that the wetland would have given us such as the provision of habitat or the natural filtration of water or acting as a natural sponge to control floods. All of those benefits when we preserve them outweigh the cost of preserving the wetlands. So in a narrow sense, yes, it will cost us more but in a broader sense that kind of includes the benefits, we're actually paying less.

Greg Dalton: But corporations and even households and individuals manage and think narrowly. Corporations are externalizing machines. They want to –

Larry Goulder: Yeah.

Greg Dalton: – bring in the profits and externalize the cost so how is that going to change?

Tony Juniper?

Tony Juniper: Well, part of it is down to policy and the extent to which governments put in place rules or ecological taxes or whatever other tools they have to be able to stop capturing and reflecting some of these externalities. But actually it's also interesting to see how some of the corporations are beginning to realize that this isn't necessarily a win-lose scenario that they are in, in looking for ways to protect nature at the same time as sustaining profit.

And there are examples across the world which I bring into the book, particularly in the water sector, whereby companies are finding it's much cheaper to conserve natural habitats as a means of securing water supplies into the future than it is to be building reservoirs, and filtration plants, and other engineering solutions.

And so, for example, Bogotá in Columbia, there's a very ambitious project going on there being helped along by the Nature Conservancy, a U.S. NGO, they're trying to restore upland woodlands in order to reduce the amount of sediments coming off of the hill which are getting into the water because those sediments cost a fortune to remove. If you can keep the sediments on the hill by replanting the forest, then actually you're cutting costs, not increasing costs and that's a project that's happening now with the backing of major corporations.

If you look across the globe and there are other places where this is happening too. It's already happened around New York City where there's been a very effective enhancement of the natural environment in order to improve water security, at the same time, is cutting costs for companies. And indeed in that case, also cutting costs for the people paying water bills, the people living in New York City.

So this is something that is beginning to be seen as not necessarily so black and white in the sense of protecting nature brings costs and, in fact, is something that can be seen to be enhancing profit. And actually, in the case of those instances where natural habitats have been protected to reduce the sedimentation going into the water, you're getting a whole range of co-benefits.

And so in the case of the Columbia project, that would be reduced flood risk downstream as less water is coming off the hill in one big pulse causing damage to property that will be carbon enhancement as the soil carbon and the vegetation begin to take CO2 out of the atmosphere, and they'll be a massive conservation benefit as some of the endangered wildlife there has more habitat.

So these things are beginning to be seen as not so much of that kind of straight choice which sometimes the knee-jerk reaction in politics withhold is there. And actually, as Larry says, with a bit of thought, you can start to see some really exciting ways to innovate, not only to protect the environment but also to enhance profitability.

Greg Dalton: Larry Goulder, the Catskills.

Larry Goulder: Yes, I'll jump in here. Economics is referred to sometimes as the dismal science and I'm going to offer a little bit of skepticism here. I do agree with Tony that in many cases, many more cases than we've taken advantage of, we can find profitable ways to preserve nature, ways that actually would lower our costs. I do think, however, we would be a bit naive if we think that those situations are always going to work, that we're always going to find cases where industry is going to find it less costly.

I'll give again the example. If you require farmers to change their agricultural practices that may exert a cost but there's good news behind the bad news. Even in those cases where it does imply a cost to particular agents or to particular producers, again, the environmental benefits are worth more to us to society than these extra costs.

Larry Goulder: So where we have to be clever is to find compensation schemes –

Larry Goulder: – where the winners compensate the losers. And as a result, everyone is better off. So we have to find ways basically to oil the squeaky wheels, to find ways to compensate those or subsidize those who would otherwise form a strong group to oppose this politically, and to make it worthwhile for everyone. There's enough benefit there to pay off those who would otherwise lose but finding ways to do it is difficult.

In the case where there is – the effects are in the short term and the parties are all closely connected, it's easier. And in cases where, for example, a climate change where the beneficiaries are often future generations or where there's great uncertainty involved, it's a lot harder to convince the public to pay, for example, to prevent deforestation. It's harder to enlist folks the potential beneficiaries to pay off those who would otherwise lose.

Greg Dalton: Tony Juniper, at the University of Cambridge, there are some companies that are sending people there because they're starting to realize that this economic of enlightened self-interest resource constraints and they're training people to get up on these things because they see risk, they see opportunity. Tell us about that.

Tony Juniper: Well, through the Cambridge program, we're seeing quite a few companies coming with the intention of developing really quite ambitious programs to realign their business strategies with these kinds of natural capital opportunities as well as constraints and the motivations for this that quite varied. Some companies are coming because they see reputational risk and so they see their customers going elsewhere or they see themselves vulnerable to attack by NGOs because they're on the wrong side of the argument when it comes to, for example, the depletion of natural forests or the damage to freshwater.

So they're coming because they think society is going to reject their products because of the way in which they're impacting on natural capital. Others, and there's an increasing number of these, are coming because they see a strategic, systemic business risk at hand and companies that are in the agricultural sector, in particular, so companies tea, coffee, cocoa, peas, beans whatever, they have seen already the volatility in prices linked back to climate change events or at least extreme weather arguably linked to climate change. And they have realized that 20, 30, 40 years out, it might be that a combination of soil damage, lots of pollinating insects, extreme climate events and the scarcity of freshwater could be meaning that their supply chains are no longer secure and that they will be unable to supply the products to the markets which enables them to make profits for their shareholders.

So they're seeing a systemic major risk at hand and they would like something to be done about it. And that brings us back then to the point about where you don't get the win-win necessarily and where you need governments to be intervening. And there's all sorts of things that governments can be doing to help these companies maintain their supply chains into the future in terms of, for example, reducing greenhouse gas emissions, reducing much in pollution into water and some of these things are, for example, ecological taxes, emissions trading schemes. Those are two tools that the governments have their hands on.

Another one, which I think would be huge based on the energy in agricultural sector, will be to shift to hundreds of billions of dollars worth of public subsidies every year that are going into what you might regard from the point of view of natural capital as the wrong kinds of technologies. So, the subsidizing of fertilizer use in waste which is causing damage to the coastal fisheries and freshwater, the subsidizing of oil and gas which is causing damage to the atmosphere, governments have got their hands on those levers.

And quite a number of the companies that I'm working with who see the growing risk out in front, they would like government to be pulling those levers now. And so it's not so simple actually. You hear about the effects and the impacts of lobbying by vested interests. I think as a whole group of new vested interests emerging who are not the old ones who like to keep the subsidy regime as it was but a new group of interest who would like things to change in order that that business can survive.

And perhaps what we're going to see in the next 10 to 20 years is quite big disagreements between different industrial groups. For quite a few years, you've had the impression the industry or the private sector would like government to get out of environmental law making because they prefer to have a free market. I think what you're going to see quite soon is winners and losers.

So companies in the fossil fuel sector are going to be seeing quite soon as actively hostile to companies trying to build sustainable agricultural supply chains because climate change and the volatility that's going to come with it is going to mean that Shell or Chevron is going to be in direct opposition with Unilever or Nestle. And I think that's really quite an interesting dynamic.

Greg Dalton: Big food versus big oil, okay. So Larry Guilder?

Larry Goulder: First of all, Tony mentioned that because of climate events that we have very significant weather-related cost increases. And at least there's one channel through which you might think you can help gauge industry to say it's in their interest to help promote policies that would have led climate change and that their cost of dealing with these weather-related events have increased a lot.

The numbers are a little bit suspect or the data are not perfectly clear. But back in about 1980, the total damages associated in the U.S. from weather-related events was about $3 billion. Now it's $20 billion maybe even slightly more than that. Now we can't – not all of that is necessarily due to climate change but there's at least the suspicion that a significant part of it is. And so this is a cost of business and to some extent that I think the extent to which books like Tony's and other studies can really make this connection, it might help engage more of the business community into doing something about it.

Greg Dalton: But if corporations can have taxpayers shoulder those costs and they can continue to deliver their profits to shareholders, that's a good deal for them.

Larry Goulder: I think that it's appropriate for we, as a society as a whole, who are going to – who would benefit from avoiding climate change or more generally from avoiding the loss of nature services. Since we are benefiting from the avoided damage, it's reasonable for us to help cushion the burden on the companies or the agricultural interests that are making the changes. Again, that allows for the possibility that all parties can benefit. We, society as a whole, plus the companies that would otherwise shoulder the cost.

Greg Dalton: But the reality is poll after poll shows that the environment ranks pretty low among priorities for American voters. And even more so when the economy takes a downturn, they care about their own jobs, their own economic security, family, health, et cetera.

Larry Goulder: Yeah.

Greg Dalton: So this could be seen as an elite left coastal kind of concern.

Tony Juniper?

Tony Juniper: Well, that's why I write the book because exactly the same problem prevails in the United Kingdom in the sense that the environment is pretty lowdown in terms of the list of things that people say are their priorities for politics. And actually, with the economic downturn, the environment is going to even lower down.

But the point I'm making is, this is not an environmental issue, it's an economic issue and if we don't protect nature services, then the economy is at threat. And if you look at all the things that we get from nature in terms of food, in terms of freshwater, in terms of the productivity of the ocean, defense from extreme conditions, all of these things are economic benefits.

And by repositioning this discussion as one which is about sustaining the economy rather than something which is about birds or bees or whatever else, I think is the way that we have to go and not simply because I want the environment higher up as a political issue because this is real economics. And the longer we ignore this, the greater threat and jeopardy we're going to pose to stability, productivity, progress and growth later on.

Greg Dalton: What are some specific companies that are recognizing this that are actually making this a policy issue and training and reordering their business strategy around this kind of risk management partly and partly an opportunity either one. Larry Goulder?

Larry Goulder: You've mentioned the case of Bogotá, the companies like Dow Chemical that are actually behind this. Alcoa also is surprisingly is behind this. This is a project where the downstream beneficiaries from cleaner water are paying those upstream to change their practices. So it's good PR for some of these companies. And in addition, some of them would benefit by having to spend less on in taxes to build new water treatment plants.

Greg Dalton: Unilever is another one.

Tony Juniper: Unilever is another one and that that company has gone quite far in trying to understand the total impact of the company, and not only looking at the supply chain and the greenhouse gas emissions or the chemicals or the water involved in the production of different products but also looking beyond the company and the consumer. This is really quite exciting in the sense of looking not only at the fields and then what's taken to the factories and turn them to a product but also looking at the consumer and their behavior.

And so for example, Unilever looks at the overall carbon footprint of using that teabag and would you believe 70 percent of it is down to you and I boiling a kettle in the kitchen. And so part of their program is to not only be working with the tea farmers upstream to be using less chemicals, conserving water, to be enhancing biodiversity on the fields and then taking the product to the factories and having super efficient clean production to be able to turn that into a nice product but then looking down to the consumer and encouraging them to be buying super efficient appliances and, for example, boiling one cup of water if you're going to make one cup of tea.

And so, that's taking a really quite a broad view of this that's being led from the top. It's right across all of the hundreds of products that the company is making and is really quite an exciting platform. And the chief executive of Unilever, he says that this isn't simply about doing ethical business, this is about sustaining his company long into the future by protecting all of the assets that they need and indeed by building better relationships with the customers who are using the product.

Because if you can engage customers in using less power, they're going to be saving money, they're going to be feeling good about the product, they're going to be feeling good about the company and the brand that's bringing them this kind of information and advice. So he's making 100 percent business case for this. He's not saying something that's done because of some kind of campaign from Friends of the Earth or Greenpeace or something that is a bit fluffy. It is solid business and you're seeing this now coming time and time again from a whole range of companies.

Larry mentioned a couple of others. General Electric in this country too is also going on this path. A major construction company I work with called Skanska are trying to build the world's greenest buildings and by doing this because they can see the market changing and they're helping their clients to be anticipating, for example, the kind of agenda that people renting commercial property in 10 years will have.

Do we think in 10 years that big financial companies are going to be wanting to hire energy inefficient offices or will they be looking for carbon neutral, super green, eco-efficient buildings? And of course it's the latter. That's the way the world is heading and Skanska is helping its clients to go there. Again, it's a very strong business case, not something that is simply about a vague ethical environmental agenda.

Greg Dalton: If you're just joining us –

Larry Goulder: I think there's –

Greg Dalton: Larry Goulder, go ahead.

Larry Goulder: There's a lot of reasons to be encouraged by the developments that Tony has just articulated. But getting back to this issue of education and getting the word out, I think that's going to be critical for another reason that as you inform more people about the nature of the problem, about the difficulties associated with the loss of important ecosystem services that that will help bring about, hopefully, grassroots support for public policies.

Larry Goulder: Because as, I think, Tony and I would agree, a lot of it is going to come from the business community on its own but a lot of it is going to require a change in the economic environment through public policy. Just to take an example. We right now have about 30 percent or less of the wetlands in the U.S. that existed at the Colonial Age.

Some of that land conversion was probably a good thing. We created more value by draining the wetlands and doing something else on the land then the value that was generated from the wetland. But we've also, to a large extent, lost more wetland than would be best for society in terms of the loss of the various services that are provided.

Just informing farmers that, in fact, wetlands have a significant amount of ecosystem services to provide is not going to prevent them from wanting to purchase wetlands on the cheap and dry it up and convert it to agricultural land. Because those benefits that are lost when the wetland gets drained accrue to society as a whole, not to the farmers, so you need some kind of public policy whether it be direct controls, constraints on the amount of wetland conversion or some economist would suggest a wetland conversion tax which basically tries to make sure that if a farmer is going to purchase a wetland, he or she is going to have to pay a price not just equal to what the owner of the wetland would want to sell it for but also would pay a price equal to the lost value of the ecosystem services.

So I'm basically making the point that there's a strong role for public policy in addition to the role for individual behavior by business community and others.

Greg Dalton: And how many politicians are going to run for office saying, "I'm going to tax those farmers to pay for all that they're doing?

Greg Dalton: That's a tough question.

Greg Dalton: If you're just joining us on the radio, let me say this, that our guest today at Climate One are

Tony Juniper, associate professor at the University of Cambridge; and Larry Goulder, professor of Environmental and Resource Economics at Stanford. I'm Greg Dalton.

Tony Juniper, you're going to say something?

Tony Juniper: I was going to say that the choices that politicians can put to the electro is going into voting and choosing who to represent the people at the time of new governments being fold. It isn't simply a question of saying, "We're going to tax more." It's about saying that we can be shifting subsidies, for example, and to be getting better value for the taxes that are being spent. It's about bringing in new opportunities for market mechanisms to be deployed. It's about offering opportunities for those companies that want to go in the right direction to go further and all of these can be delivered through a different kind of narrative.

And I think really that's the heart of what I'm trying to say in the book is that we need a different way of framing the economic conversation and getting away from this fool's choice, which presents us with the idea that looking after nature is somehow a cost. I would argue that it's an investment and in many cases, a huge opportunity.

Greg Dalton: Let's talk about the difference between Katrina and Rita that you write about the two storms that hit very similar places in the Gulf of Mexico with very different results.

Tony Juniper: Yes. As a piece of research, I look at it in the book which is about the role played by ecosystems in helping to protect property in life from the effects of extreme events, whether that be the impact of storms hitting coastal areas, the effects of tsunami waves or indeed the effect of inland flooding, and how all of these things are, to a large extent, reduced in the risk that they pose through natural habitats.

So the comparison between the impacts of Rita and Katrina is a very good example of this in the extent to which one storm caused something like $85 billion worth of damage, led to tremendous misery in New Orleans, killed about a thousand people, and really delivered a terrible blow to a large area of the United States.

Whereas a very similar size storm which hit three weeks later to the west admittedly hitting an area with less dense population but, nonetheless, hitting an area where there was property and people living, and caused seven deaths and minimal damage. And the principal difference between the effects of these two storms was the state of the coast to wetlands where they made landfall with the wetlands around New Orleans being heavily degraded with deep ship canals being cut through, whereas Rita came ashore in an area where the coastal wetlands were pretty much intact.

And about 90 percent of the storm surge power was reduced by those wetlands as the storm made landfall. And you see a similar pattern repeated in analysis around, for example, the effects of the 2004 Asian tsunami, that one that hit on Boxing Day, the earthquake beneath the Indian Ocean. That sent a shockwave across many countries from East Africa right through to Thailand and Malaysia. And the damage caused was much more serious than those places where the coastal mangrove forest and the coral reefs have been degraded.

And in some places, the coral reefs were removing 90 percent of the energy in the waves before they hit the coast and that essentially I described in the book as a kind of an insurance policy keeping those wetlands intact. You may not need them and hopefully you never will need to protect yourself from a tsunami wave. But if you do, having those kinds of natural habitats in place is a very good way of reducing the risks that people face.

Greg Dalton: So natures crumple zones. Larry Goulder?

Larry Goulder: Just closer to home we have an example in the city of Napa, the Napa River often would overflow its banks causing considerable flood damage. But part of it is the area that would have been wetland, that had previously was wetland and was kind of a natural sponge and would help control the floods, had been developed for industrial purposes –

Larry Goulder: – and also for some residential purposes. What the city did some years ago is rather than have the Army Corp of Engineers come in and basically build larger walls to harness the river, they took something – did something else which they found was ultimately better for everyone which is to pay off those who were on this previous wetland area to relocate, compensated them then restored the wetland.

And as a result, even though there's still flooding in the area, the flood damage is somewhat less. Now I should mention that this somewhat – remains today as somewhat controversial issue. There are some that think they should have gone with the old engineering approach. But for many, if perhaps the majority of those in the area think that is a way to do it, also you have to recognize it as a result of this plan; they were able to introduce some new recreational areas and some wildlife preserves. So I think overall, the city is content with this approach.

Greg Dalton: Let's talk a little more about California overall. California prices have been having some very green policies in place. Larry Goulder, you worked with the state of California. Is California getting the economic incentives in line so that it's valuing nature and thinking about this in a carbon-constrained world?

Larry Goulder: I think the closes connection I could make is to California's effort to try to encourage new agricultural practices that – land practices that would maintain or enhance carbon storage. I can't say whether they're doing enough of that but they certainly are attending to that because the ability of terrestrial areas to absorb carbon, whether its forest or other areas of land, it's just very important in controlling in limiting the concentrations of greenhouse gases in the atmosphere. So they're certainly paying a considerable attention to it.

It is also the case that primarily the attention in California has been more on industrial emissions of greenhouse gases but through their offset program, I think they also are attempting ways to kind of enhance climate regulation through absorption of carbon in the land.

Greg Dalton: Tony Juniper, you write that there's more carbon in the soil than there is in the atmosphere and that the soil really is a big part of the carbon equation that got to get more attention and more –

Greg Dalton: – so that's more resources.

Tony Juniper: And the points I'm making there is how many natural systems we just look at them for the market, the immediate market value that they can provide for since those soils we look at as a way of producing food which can be instantly sold into the market. And as we do this, we miss some of the other things that the soils are doing, and the big thing, which is on the agenda, now causes climate change.

And the contribution being made by the world soil is absolutely huge at the moment in terms of emissions in particular but potentially if we manage soils differently in terms of being able to take carbon dioxide out of the atmosphere. And I start the book really with a story of a place near where I live in Cambridge, which was drained in the 1850s in order to open up an area of wetland for wheat production.

And when this area was drained, the local landowner put in to the peat soils there a great iron girder which was about eight meters long and it pushed it through the peat down into the clay beneath. And he put it into the ground so the top of the iron girder was at ground level in 1852.

If you go there today, the top of that iron girder is five yards above the ground and what's happened is that the ground shrunk across hundreds of square miles of North Cambridge across this area of wetland. And that soil has basically turned into carbon dioxide because peat is basically the unwanted plant remains, accumulating in the wetland over many, many centuries, is basically comprised of carbon. When it's dried out and exposed to the air, the carbon unites with oxygen and it turns into carbon dioxide.

And so as well as we've managed to grow a bit of food in that area over the last century, we've emitted hundreds of millions of tons of carbon dioxide and the government, of course, is spending a fortune trying to encourage energy efficiency, solar panels, wind turbines, all of these things that are essential but we've ignored the vast contribution being made by the soils doing that work for nothing.

Greg Dalton: Wow. Okay. Is Europe ahead of the United States in managing this or where do Europe and the United States fall in terms of recognizing the economic system and the natural systems connected in a way? Tony?

Tony Juniper: I think it's mixed. I think it's mixed. I think across the world you can see leadership coming from corporations both here and in Europe. I think probably I would say that the United States is a bit ahead in terms of how business is looking at this. And I think probably that in turn is linked to the extent to which some of your big nongovernmental groups like the Nature Conservancy and Conservation International have actually made it their business to talk about these kinds of things in the way that we're doing today. They try to make nature an economic issue and they try to engage the big companies on that and they've had some success.

In Europe, there are some companies going in this direction but it's not as pronounced. On the policy side, I think probably those are a little bit more being done in Europe compared with here. I don't study the U.S. political system on the environmental side as much as I do from the European point of view but I hear things coming from here which just sound mad in the sense of trying to cut down the budget of the Environmental Protection Agency, which of course is sustaining these services which enabled the economy to grow.

I hear about skepticism on climate change in the face of overwhelming scientific evidence that just seems completely irrational. So I think some of the policy in Europe is a little bit ahead of where we are here but I wouldn't say that the United States has no leadership potential or indeed already doing some good things it is. But I think the political side is probably a little bit behind the European side. Having said that, it's so relative what's going on in Europe is not brilliant either.

Greg Dalton: Larry Goulder, what are the bright spots you see in the United States regarding pricing carbon pollution or policy action regarding the things we're talking about?

Larry Goulder: You save the tough questions for last I see.

Greg Dalton: I got tougher ones yet.

Larry Goulder: Well, it depends what your expectations are, right? Obviously, I feel that the political situation is really very, very difficult in the U.S. now. Things are very polarized. And in terms of climate change policy – I'll give you the negative first.

There were some movement toward the cap-and-trade system through the Waxman-Markey Bill that was passed by the House in 2009 but never reached the Senate. Now the support for cap-and-trade seems to have declined since then. There are some talks about a carbon tax as an alternative at the national level to perhaps be part of a broader tax reform effort. But even then, the overall support is kind of weak.

If you ask me for bright spots, I would say that I was encouraged by President Obama's reference in his State of the Union Address to the climate problem and he's basically throwing down the gauntlet in saying that if Congress isn't going to pass a national climate bill, that he will take actions through the Executive Branch. So I am encouraged by that and the sense that one gets is that he is serious about this and the EPA is already drawing up plans to control carbon dioxide under the levers or the hospices of the Clean Air Act.

So I think that that will do something. I would have preferred there be a legislation that could either introduce carbon pricing through cap-and-trade or a carbon tax. I think that would be a more cost-effective way of achieving the reductions but I'd certainly would be happy for half a loaf in the form of this executive efforts to control, in particular, emissions from coal-fired power plants.

Also a bright spot is that many states are already taking pretty significant action through, for example, renewable portfolio standards, which impose a certain minimal proportion of clean or renewable energy that has to be purchased by utilities as a proportion of the total energy that they purchase. So there are some bright spots but we have a long way to go. I think, again, getting the word out and help getting grassroots support is a key to getting political action.

And just as it turns out though that there is already considerably more support at the grassroots level for vigorous climate change policy then there is support among our elected legislators in Washington D.C., and you can perhaps invoke special interests as an explanation for that, that many politicians recognize that climate change, for better or for worst, is not a decisive issue in terms of getting elected. They can violate the preferences of their constituents and still get re-elected as long as they have the right vote on more decisive issues like abortion or gun control or the economy.

Greg Dalton: So

Tony Juniper, perhaps corporations are the bright spot where leadership can happen?

Tony Juniper: Yes. And I think the challenge for those of us engaged in this transition from where we are to this more rational economy with nature built at the heart of it, I think one of the jobs we have to do is find ways to give market advantage to those corporations that are beginning to show leadership. And so how is it going to be possible for Unilever to be gaining more market share at the expense of its competitive off of Skanska to be building more buildings than its competitors?

And I think this then comes down to the grassroots side to an extent as well in terms of where consumers are showing their preference to where they want to shop and raising awareness amongst the client groups or some of the business-to-business enterprises that are principally doing work with other companies.

And so for me now, that is the big challenge is how those companies that are in the leadership position can start doing better than their peers who are not. And I think once you can start building that kind of dynamic, you get a virtual snowball where everybody is trying to catch up with the leaders rather than the raise to the bottom that's going on at the moment.

Greg Dalton: So you're asking for government to favor certain companies?

Tony Juniper: I'm asking for the government to pay the certain outcomes and then the companies that are able to achieve those outcomes to be doing better in the market than those who are not. And this is something that is not alien. It's just a question of applying that kind of thinking to the environmental side.

For example, we are very used to having health and safety laws. You're not allowed to put poisonous substances into toys that are being given to children and so why is it that we allow environmental abuses of a kind, which are quite irrational. So I think it's about making that political leap to see the environmental agenda as very much part of the economic one and then to be putting in place the kinds of tools, whether they be in the market, whether they be taxation, whether they be trading schemes to enable those companies that are in the lead to be leading even better than they are now. That's what it's about in my opinion.

So it's not about replacing the market with regulation. Regulation is essential but the market mechanisms could also be there and it's about giving the signals that are going to take us away from the destructive short-term policies that we're relying at the moment to a much more rational joined up in long-term approach for business.

Greg Dalton: Larry Goulder, should governments interfere – intervene in markets in that way that favors –

Larry Goulder: It depends what you mean by "in that way". But the way that Tony described it, I would be very much in favor of. Basically, what I hear you, Tony, is suggesting is we should require that businesses take into account the full cost of their activities –

Larry Goulder: – including the external costs.

Greg Dalton: Pay for your waste.

Larry Goulder: Not just what would ordinarily be the private cost. In doing so, it's not meant to be punitive but it's rather to align the pursuit of profit with the overall public good.

Larry Goulder: And if one does that, then going and doing right by the environment will give you a market advantage and will produce the kind of results. So it's not picking winners per se, it's rather incorporating through direct regulation or through price mechanisms. A way of having producers take into account of all the costs involved – all the society's cost when they produce.

Greg Dalton: Larry Goulder is Professor of Environmental and Resource Economics at Stanford. Our other guest at Climate One today is

Tony Juniper a professor at the University of Cambridge and author of

What Has Nature Ever Done For Us? I'm Greg Dalton. We're about to go to audience questions but first I want to ask you, what you do yourselves to manage your own carbon footprint and maintain a connection to nature?

Tony Juniper?

Tony Juniper: Well, I don't help it by flying to the United States to talk about my new book but the calculation I make there is if enough people hear about the ideas in it perhaps there is an offset there, which makes it an overall beneficial contribution.

Greg Dalton: So you're putting it on them. It's on you now. Okay.

Tony Juniper: Aside from the airplanes, we have a very efficient home. We have a very efficient vehicle. The vehicle doesn't get used very much. We cycle and walk everywhere and we grow quite a bit of our own food in the allotment that we have nearby. We recycle pretty much all of our waste. What else do we do? So that's for starters.

Greg Dalton: Lots of English lots of meat in the diet?

Tony Juniper: Fair bit of meat but we get it from local farms where the animals have been looked after properly. For me, the transition to more sustainable agriculture would involve more organic farming.

Animals are essential for successful organic farming so I feel quite comfortable about eating meat as long as the animals are kept properly. And actually, animals can be part of the way in which we increase soil carbon so I think that can be some virtuous connections there. But too much meat in the global diet obviously is driving us in the wrong direction but I think probably that's as much about the way the meat is being produced as much the kind of diets that we've got.

Greg Dalton: Larry Goulder?

Larry Goulder: Well, my girlfriend says that I don't recycle enough so I'm improving on that score. I guess one thing I'd say is I just bought a Chevy Volt.

Greg Dalton: Which runs partially on 40 miles on electricity. Okay.

Larry Goulder: Yeah, I like it.

Greg Dalton: Lets go to audience questions. Welcome to Climate One.

Male Participant: Thank you guys for coming out. I wrote it down so I don't go over it. Anyway, so I feel like traditional financial standards and economic concepts, things like company value – how the company values land and GDP and value of money are somewhat counterproductive to these ideas of valuing nature and its potential benefits to society promoting natural capital valuation. So I ask my question is how do you guys see these traditional financial standards and our economic concepts adapting to a post-industrial revolution economy that we live in now?

Tony Juniper: I think you're right in invoking the way in which we're looking at finance and the way in which we're measuring performance as being a big part of the solution to this apparent dilemma that we're in. And happily however, there's quite a lot of work going on around the world to try and correct this with different organizations and processes, for example, TEEB for business which is about the economics of ecosystems and biodiversity and how business can begin to start accounting differently for its impacts.

There's another process called the International Integrated Reporting Council. Both of these things are trying to look at ways in which companies can start to report the environmental benefits and damage they're causing alongside the financial profit and loss and also doing that in terms of their social impacts as well. So are they creating jobs, are they helping society to thrive? This is not simple as you can imagine.

But if we can begin to capture a much more comprehensive set of numbers so that not only our company is looking at the financial bottom line but also the ecological top line and that being reported to shareholders and society then we start to go to some very different conclusions to the ones that we reached now. Whereby we see one figure, the profit and the other two, the society contribution and the environmental impact is hidden from view completely. So I think that is the correct assumption that we need to be able to get into this different world through different kinds of accounting. I think that's essential and it's coming but it needs to go quicker.

Greg Dalton: And one company, Puma, recently came out with a profit statement that said, "Here's our profits but if you fully account for the externalized damage, our profits would be about 30 percent of that whole."

Greg Dalton: And they hope to use that as a model for other companies to say, "Here's your profits and here's your fully integrated profits." Larry Goulder, would you want to add anything?

Larry Goulder: Yeah. I would simply distinguish between the economic incentives often faced by many in the private sector by many businesses. And what good economic analysis would recommend in a world where we don't have all the external costs internalized, yes, there's going to be this deviation. But I think good economic analysis ultimately is the friend of nature. It comes up with programs or suggests policies for protecting nature services and basically enhancing the social value that we get as a result of protecting nature despite the cost that may be involved. So I really see there being no conflict.

There is one problem, of course, that we're so much wedded to some of the measures of economic success that that can distort our thinking. GDP, gross domestic product really doesn't take into account the nature services or many of the loss of nature services, which would actually mean that we may not be doing as well as we thought. So one thing that really is important is to come up with better measures and many of my colleagues at Stanford are working on doing that and coming up with alternative measures that are more consistent with our true well being and sustainability.

Greg Dalton: There's another group the Sustainable Accounting Standards Board working on –

Larry Goulder: Right.

Greg Dalton: – on rules for that sort of thing. Let's have our next audience question at Climate One.

Gary Latshaw: Thank you for this opportunity. Gary Latshaw from Cupertino. So the question I have for perhaps both of you is what you would think of a compromised or trade-off between getting rid of like mileage standards or renewable energy standards versus actually taxing carbon or a cap-and-trade system?

Greg Dalton: Economist usually favor taxes like Cleanway. Larry Goulder?

Larry Goulder: Well, this was a perfect plug. Tony is showing his book. I have a paper, an academic paper that I just finished.

Greg Dalton: It's campaign.

Larry Goulder: It compares renewable portfolio standards with cap-and-trade or carbon tax. The bottom line is it can be just as cost effective in our RPS, that kind of standard.

Greg Dalton: Renewable Portfolio Standard.

Larry Goulder: As cap-and-trade or carbon tax under some circumstances. In any case, it's not much worse and my view is we have so much to gain by introducing any of this policy in RPS, cap-and-trade or a carbon tax relative to doing nothing that we might be happy with any of the three.

Greg Dalton: And it's false to think that the status quo is cost-free. There's cost now –

Larry Goulder: Yeah.

Greg Dalton: – of what we're doing. Let's have our next audience question at Climate One. Welcome.

Male Participant: Thank you both for being here tonight. Speaking of books, Adam Smith wrote a book called The Wealth of Nations, which is kind of the cornerstone of modern day capitalism. He also wrote a book called The Theory of Moral Sentiments some 17 years prior. So he writes, "The produce of the soil maintains at all times nearly that number of inhabitants which it is capable of maintaining." He then goes on to say, " They are led by an invisible hand to make nearly the same distribution of the necessaries of life, which would have been made, had the earth been divided into equal portions among all its inhabitants, and afford means to the multiplication of the species."

So is it time to look at Smith differently as an economic Northstar for sustainability?

Tony Juniper: So his point was that the soil is the basis of our wealth. Is that what you're getting at as you think?

Male Participant: He specifically says, "The produce of the soil maintains at all times nearly that number of inhabitants which it is capable of maintaining," i.e., limiting growth written famously in 1973.

Male Participant: So Smith wrote 17 years prior to The Wealth of Nations –

Male Participant: – about sustainability so is it time to look at Smith in a different light?

Tony Juniper: Indeed. And I think he's probably one of the most misunderstood thinkers of his age in the sense to how his ideas have been twisted into the extreme forms of free market capitalism that we see today when in fact he was talking about something very different indeed. And there's an institute in London called the Adam Smith Institute, which speaks in the name of that particular writer that says things that he never said in the sense of how it's now been twisted into this globalized form of footloose capital. I think if we went back to Smith and actually looked at them literally, we'd have a very different economic system if we were taking his inspiration to guide us now. You've probably known much more about this than I.

Larry Goulder: I don't think I do but I agree with what you just said. I think it's very important not to misinterpret Smith as indicating that unfettered markets will always produce the most desirable social outcome. He certainly didn't indicate that. In fact, Smith was very, very skeptical about the potential of business community to form monopolies.

Larry Goulder: And about the so-called spillover effects associated with unpriced resources. So I very much agree with what you said.

Greg Dalton: Let's have our next audience question. Welcome.

Male Participant: Hi. Thanks for your talk tonight. So one of the things that you had said that interests me was that companies aren't always going to be economically advantaged for valuing nature and so the public is going to have to pay for the cost that they incur. And so I was just wondering, and you provided an example of a wetland tax, but how we quantify these benefits and how much the public should be paying it to offset these costs and how that calculus works out and the difficulties that are entailed with that?

Larry Goulder: Quantifying the benefits is very difficult. One of the easier cases would be, for example, the case of the Catskills where they had two alternatives and they could figure out the cost of each. And the Catskills catchment was compromised in the sense that it was providing clean water to the New York City area but because of agricultural practices upstream. It was no longer functioning that way. So the city of New York had a choice of either building a new treatment plant at a cost of about $6 billion to $8 billion –

Larry Goulder: – or instead paying off farmers upstream to change their practices and allow this catchment this Catskills area to harness nature's natural water filtration services and that only cost about $1.5 billion. So that was pretty clear because you knew how much subsidy you had to do, had to introduce in order to encourage the farmers to make the changes.

What's much, much harder is the case where you don't have these clearest alternatives that instead you're considering a policy safer example of trying to prevent deforestation, and you don't really know exactly what the benefits are. Many economists, resource economists make their living trying to measure these. What's the benefit for example from avoided climate change?

Well, you can do surveys, you can also try to figure out the impact that climate change would have on agricultural productivity, what would be the cost of sea level rise? That's all very imperfect so it's very, very difficult. Nevertheless, I think it's pretty clear economists, resource economists speak with one voice that there are these negative externalities that needs to go in the direction of pricing them, which is much harder to figure out how big those prices should be.

Greg Dalton: Let's have our next question for Larry Goulder and

Tony Juniper at Climate One.

Female Participant: I just want to thank both of you so much for your talk. It's one of the best environmental talks I've heard for what you're doing. I'm very concerned with the very slow progress. We've done so much destruction already and so many species are being killed, plants and animals. Do you have a lot of hope? I mean I think it does take intervention and laws and the government stepping in and they're not concentrating enough on those. It's getting a little late I think.

Also I was wondering are bees still – a lot of bees dying and do you happen to know what the factors why that's happening? And you mentioned meat, the meat industry, that's a major cause of global warming because of all the methane gases they emit.

Tony Juniper: I do but just first of all on the pessimism or optimism, come to think of it. I met with the region explorer recently and he gave me what I thought was the best answer to that. He said it's too late for pessimism. So I think we have to assume that thinking the worse doesn't really help and we've got to go for the solutions wherever we can find them.

On the question of what's happening to the pollinators globally, it's a complex picture and it varies some place to place but really four or five things involved. The first thing is the destruction of habitat. So bees, butterflies, moths, beetles and the other insects that do pollination, they rely on plants to complete their life cycle both in terms of the larvae that feed on different plants to grow and also the flowers they need to be able to collect nectar.

On top of that is changed agricultural practices. In many parts of the world, we're going from very diverse farming to monoculture farming which means if you're a bee living in an agricultural landscape, you often have a boom or bust feeding opportunities. So a field of canola flowering over a couple of weeks leads to enormous amounts of food being available but only for a couple of weeks.

The queen bee lays lots of eggs. The larvae hatch. The worker bees go to the field, off to the canola, finished flowering, there's nothing for them to eat. They starve and the colony collapses. There's that kind of factor.

On top of that is the stress being caused by lack of food and changed farming practices causing diseases to break out in hives, and then on top of all of that and possibly the worse thing of all, is the use of different kinds of pesticides, including very nasty insecticides which obviously kill these insects. It's either outright or by causing sub-lethal effects on them. So you mix all that together and you see pollinate to decline going on across the world in ways which are truly quite alarming.

I write in the book about one example of a place in Southwestern China where the pollinating insects were killed by chemicals to the point where now in fruit farms in the spring, you find entire villages of apple and pear growers in the trees with feather dusters moving the pollen between the blossoms by hand because the bees are gone. And if that's not an economic caution in retail, I don't know what it is.

Larry Goulder: On the issue of hope –

Greg Dalton: Larry Goulder?

Larry Goulder: – I'll simply say the bright spot to me is that the dialogue is changing. It looks like Tony's and other efforts have really led to a much deeper conversation about ecosystem services and the value of the natural capital that produces them. We couldn't have had this discussion and wouldn't been able to provide as much evidence of encouraging signs just 10 years ago or 20 years ago.

Larry Goulder: So that's changing. To me, the biggest obstacle is not so much analysis. Despite all the uncertainties, I think economists and other policy analysts kind of have an idea of what we can do to create a good balance between the value of nature and the value of other things. I think the real challenge is political and overcoming the special interest.

Greg Dalton: Larry Goulder is a professor of Environmental and Resource Economics at Stanford. We're also hearing from

Tony Juniper from Cambridge. Let's have our next question. Yes, we have a few minutes left.

Female Participant: Thank you. I feel like the majority of the discussion has been focused on more of the supply in terms of where the industries are interacting with the environment and how the governments are regulating the environment as opposed to demand and the consumer. Do you think a mind shift is necessary? Consumers are very materialistic and it's growing. Is there a potential to maintain current consumerism while industries like after the environment or do companies and consumers need to work together to be more aware of their demands? Thank you.

Greg Dalton: Limits to growth and consumerism.

Tony Juniper?

Tony Juniper: Well, much of my career I spent as a campaigner trying to raise public awareness, including amongst consumers in terms of the ways in which they might like to buy or shop or to use things. And I have to say, I've reached the conclusion after many years that the root of trying to change consumption from the bottom up, it's not going to work because we have to few people who are tuning in to these issues to make a sufficient difference.

It's very important to raise awareness but I think probably that's more about changing the political climate and changing patents of consumption and about creating the willingness amongst society for the companies and the politicians to do something different. So for the politicians to regulate and set different standards and set different kinds of tax regimes. And for the companies to be investing in different kinds of products and different kinds of consumer offers. So it's got to come from that side with the willingness of the consumer.

I don't think we're going to change greenhouse gas emissions from the bottom up by changing our lights. We got to change the power stations and we got to change the policies that govern the power stations. And that's not to say that the consumer doesn't have a role. The consumer has a huge role but I would say it's more in the realm of activism and politics than it is by changing the way in which we choose to live. And having said that that the Green Wheel are the better in sending signals to others.

Larry Goulder: I would very much agree and that I often to my students say, "Individual responsibility is great but we also need public policy." Having said that, there's a lot of things that we can do as consumers that don't come from public policy. If you think about recycling, there really – in many areas, a lot of the recycling is being done because consumers now have made it a habit. It's become a new norm.

Larry Goulder: It's not something that's required. So I think there's really a role for both individual responsibility and hopefully more education can affect the way that consumers want to behave along with public policy.

Greg Dalton: One final point on that is recycling creates supply. Consumers also have to buy recycled goods so that those things recycled don't end up just dumped somewhere because there's no demand, there's no market for the recycled materials that we're creating by recycling. Let's have our last audience question. Welcome.

Male Participant: Thank you. I'd like you to take a leap of faith for a moment and say we have a global dictator.

Larry Goulder: Yeah.

Male Participant: And he or she has selected the two of you as an adviser and says, "Well, it looks like we're going to have about nine billion people and what three or four things should I be doing for the planet to transform the economy in the next 40 years? And what would you tell that global dictator to do to actually make the transformation?

Larry Goulder: Right.

Greg Dalton: Larry Goulder?

Larry Goulder: Let me start off with that. I'm going to show my pedigree here. I think we should require training in environmental economics in the public schools so people understand –

Larry Goulder: – where markets fail and why allowing companies to recognize or requiring them to recognize the external cost is actually a good thing for society as a whole so it's sort of pushes away from the prevailing ideology that tampering with markets. But markets can just about do everything that we can all act independently.

The second thing is I would push that I'd be made the global czar rather than adviser. The third thing, I had a third thing.

[Laughter]

Greg Dalton: After that you have to do it.

Larry Goulder: Is that I would say encourage people to be green voters as well as green consumers.

Larry Goulder: Because it's just going back to the point of just the last question that public policy is so important as well.

Tony Juniper: So the first thing I'd say is we got to change what we're measuring and we got to move beyond GDP to start measuring the sustainable welfare of society. And measures of happiness and the extent of which we ate achieving long lives with low resource inputs is the kind of thing we should be striving for rather than more growth. And if we started to measure that, I think things would change very quickly.

The second thing I would have advice is shifting all the subsidies away from industrial farming and from fossil fuels into renewable energy and into sustainable agriculture. And the third thing, that you just made me forget now the third thing, the third thing would be to find the policy mix which is going to give us the biggest amount of low carbon energy and the strongest food security with the maximum number of jobs.

Because I think at the moment, what we're doing in the way we're developing quite a lot of the ways we look at agriculture and energy, we're taking people out of the equation. This is simply unsustainable from the point of view of society. And certainly, in my country, I see big, big tensions now coming with lots of young people being unable to find jobs. And I think what we need to do is to navigate a path forward that solves these problems, not only for deploying clean technologies, but also clean technologies that provide young people with meaningful employment.

Greg Dalton: We have to end it there. Full podcast of this program is available in the iTunes store. You can follow Climate One on Twitter at @climateone. Our thanks to

Tony Juniper, Associate Professor at the University of Cambridge and author of

What Has Nature Ever Done For Us? How Money Really Does Grow on Trees. Also, Larry Goulder, Professor of Environmental and Resource Economics at Stanford. I'm Greg Dalton.

Thank you for coming to Climate One today.

Larry Goulder: Thank you.

[Applause]

[END]